Election Imperatives

In Market Analysis onThe Election is, in our view, the most consequential driver for the Markets this year. Here’s what has changed in…

Specialized Asset Manager

In Market Analysis onFinancial advisors and portfolio managers may find boutique asset managers attractive because they are proudly independent, driven by innovation and…

Bonds Turn South as Yields Rally

In Market Analysis onSeveral months of higher inflation have brought rate cut predictions this year down to two from six in January. The…

Hedged Equity – Building Next-Gen Diversification into Portfolios

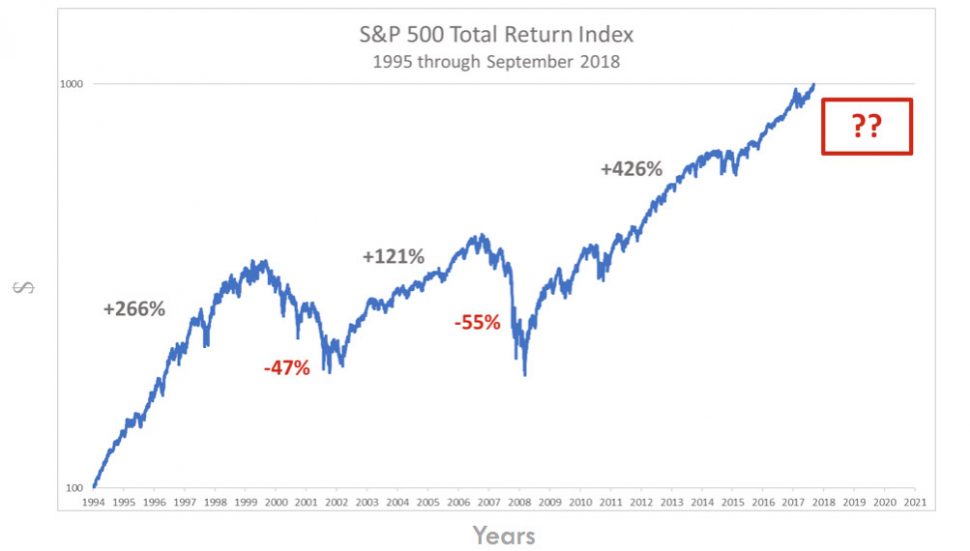

In Market Analysis onAfter experiencing four bear markets in the past 15 years, and insignificant returns for bonds over the past decade, advisors…

Market Vacillates as Oil and Yields Challenge Bull

In Market Analysis onOver the past month yields have bounced between recent highs of 4.36% and just below 4% for the ten year…

Market Bull takes a Pause

In Market Analysis onStocks have mostly been caught in a state of reverse gravity this year (what goes up - keeps going up)…

Market Update 6/16/23

In Market Analysis onI wrote my last update as we approached debt ceiling drama with no certainty a deal would get done, or…

Market Update 5/26/23

In Market Analysis onComing into the weekend, it appears that negotiators may actually arrive at a debt deal despite all of the acrimonious…

Market Update 2/16/23

In Market Analysis onOn February 2nd, I was invited to appear in Bloomberg Markets segment on Bloomberg TV to comment on the markets.

Market Update 1/22/23

In Market Analysis onOur trend-following algorithms moved us back to a fully invested position in our US Stock Allocations last week.

Market Update 1/9/23

In Market Analysis onOur trend-following algorithms moved us back to a fully invested position in our High Yield Bond allocations.

Market Update 1/3/23

In Market Analysis onWe began moving our High Yield Bond Positions defensive on Wednesday of last week. On Friday we completed those trades…

Market Update 12/27/22

In Market Analysis onWe began moving our US Stock Positions defensive on Wednesday of last week. On Friday we completed those trades and…

Market Update 11/18/22

In Market Analysis onWe began moving into International Stock Positions on Tuesday and US Stocks Positions on Wednesday this week and completed our…

Economic and Capital Markets Update

In Market Analysis onThe more extreme market declines become, the more extreme following market actions may be.

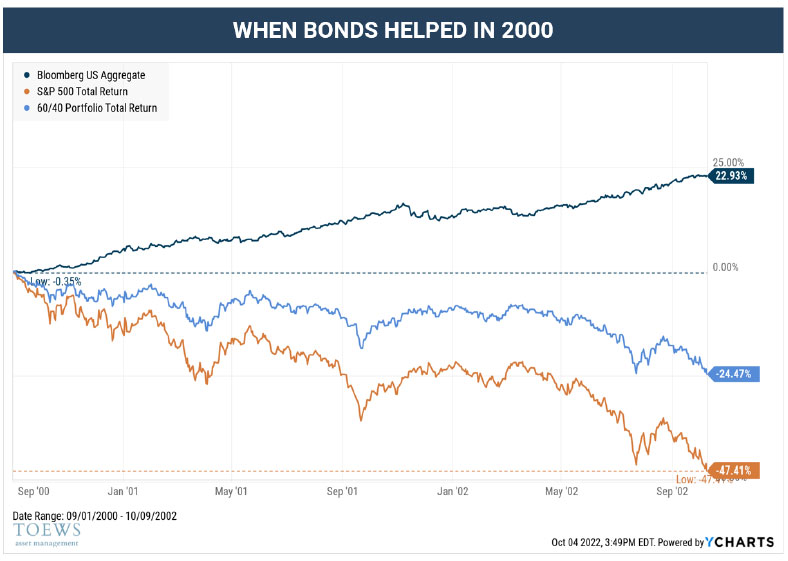

THE 60/40 DIVERSIFICATION STRATEGY BREAKS DOWN

In Market Analysis onIn this commentary I’ll discuss opportunities that are emerging as markets continue to fall. I’ll also examine the impact of…

The Danger of Complacency

In Market Analysis onWe are stuck. We have spent hours debating the jargon from the Fed like “transitory”, “growth below potential”, “soft landing”,…

Market Update 9/9/22

In Market Analysis onOne week ago today, our algos finished moving to an invested position for our High Yield Bonds allocations across our…

Market Update 8/26/22

In Market Analysis onOne week ago today, our algos finished moving to an invested position for our High Yield Bonds allocations across our…

Market Update 7/29/22

In Market Analysis onOne week ago today, our algos finished moving to an invested position for our High Yield Bonds allocations across our…

WORST START TO A YEAR SINCE THE 1970’S. CONTINGENCY PLANNING FOR THE REMAINING HALF.

In Market Analysis, Market Updates onOur strategies moved largely defensive initially in January. Twice since then we’ve moved briefly into markets and back to a…

Market Update 6/1/22

In Market Analysis onOur algos moved us into an invested position for our High Yield Bonds allocations across our models. We began scaling…

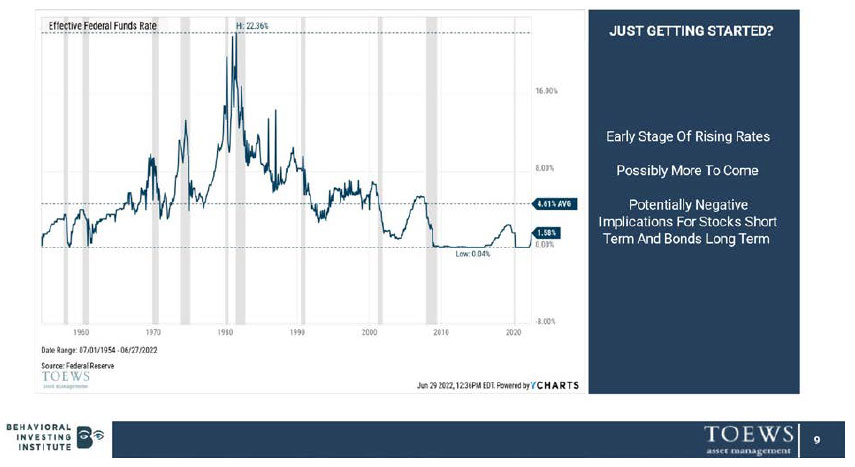

Balanced Portfolios face Greatest Challenge in Decades

In Market Analysis, Market Updates onIn our quarterly market commentary, advisors are accustomed to seeing sometimes bleak assessments about future stock market growth.

Market Update 4/14/22

In Market Analysis onAfter being long US stocks for several weeks we began to move back defensive on Tuesday and finished moving defensive…

Market Update 3/28/22

In Market Analysis onIn early to mid-January we exited US Stocks and High Yield Bonds, and later sold our International stock exposure. Those…

THE FROG ISN’T JUMPING OUT OF THE BOILING WATER

In Market Analysis, Market Updates onThe critical difference between GameStop and Amazon is that the GameStop rally was the equivalent of a retail investor Ponzi…

Inflation drives investors to US stocks

In Market Analysis onIt seems impossible to escape inflation nowadays, and Thanksgiving this year is set to hit Americans’ wallets harder as they…

Inflation Creates Paradigm Shift for Advisors

In Market Analysis onWednesday’s inflation print is further confirmation that inflation is here, it’s real, and it’s likely to continue at least into…

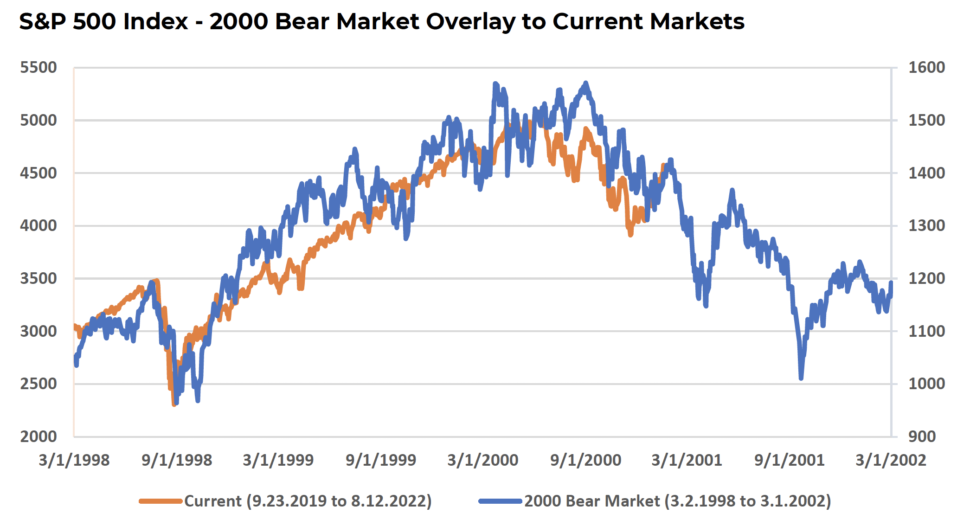

ARE MARKETS POISED FOR A CRASH?

In Market Analysis, Market Updates onInvesting can be like walking through a dense forest with no map, and no ability to see the sun. Trees…

Environment Ripe for Market Rout Time Sensitive Opportunity to Attempt to De-Risk

In Market Analysis onLosses have accelerated and broken through technical resistance, suggesting that the seasonably unfavorable months of September and October may delver…

The history of inflation in the United States

In Market Analysis onInflation has dominated much of the financial news for the past quarter as it has perked up above 4% for…

A Bubble that May Rival Tulip-Mania

In Market Analysis onIn my time as an investment manager, which now exceeds thirty years, I’ve witnessed two prior bubbles. In the late…

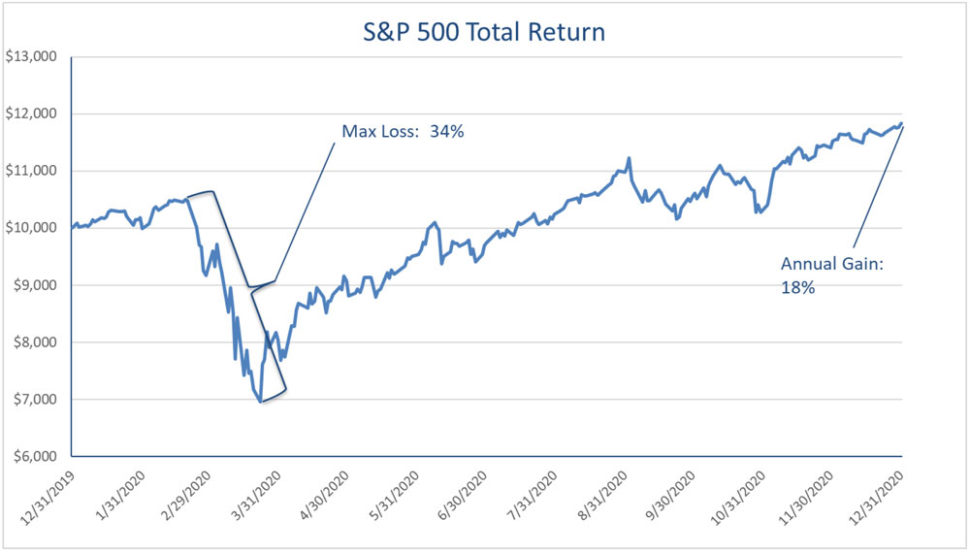

Stocks Rally in the Face of a Mounting Pandemic

In Market Analysis onFor the year, the S&P 500 moved higher by 18.4%, a remarkable feat considering the elevated levels of unemployment, business…

Markets Advance, but are Challenged During the Quarter

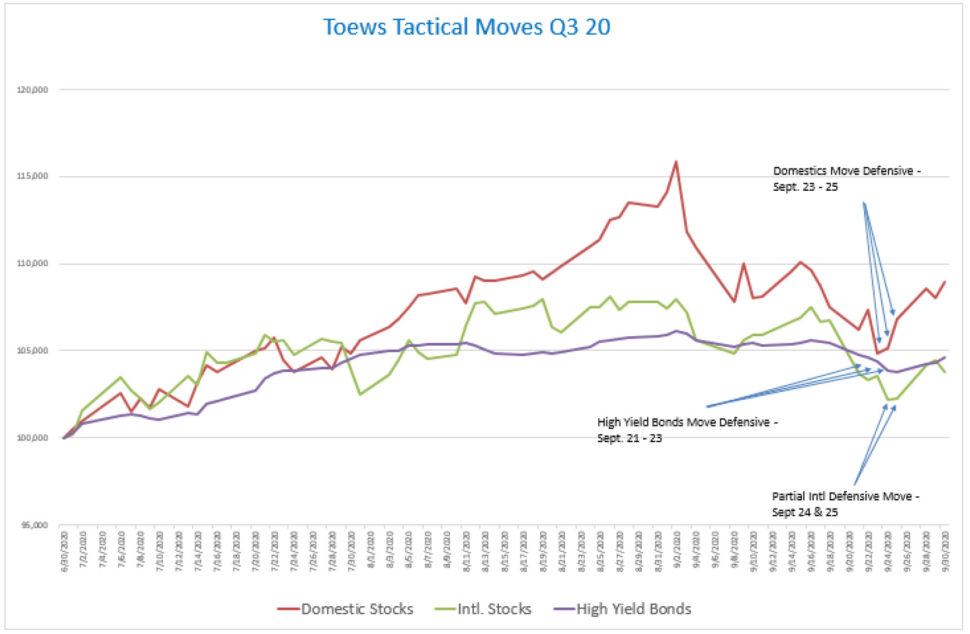

In Market Analysis onThe strong rally that began at the end of March continued through early September, and then turned lower as covid…

Toews Returns to Fully Invested Positions as Markets Rally

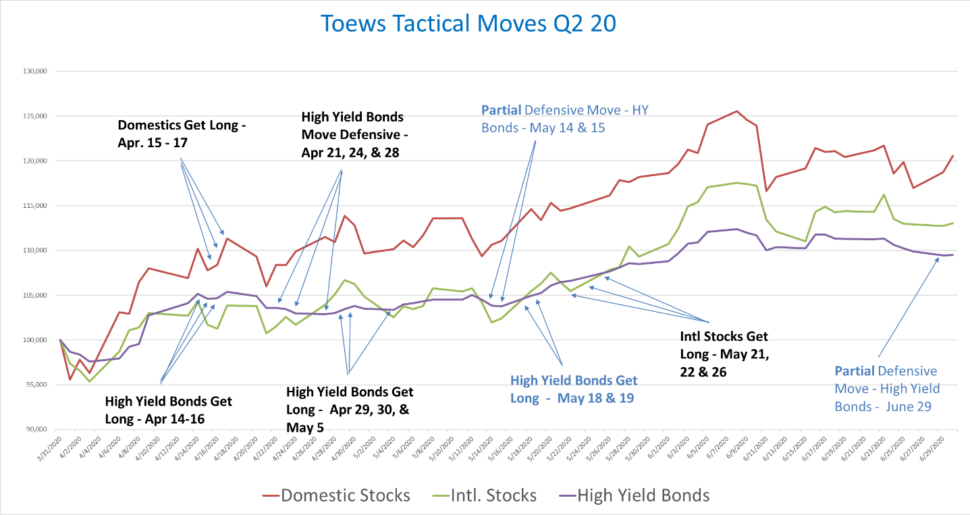

In Market Analysis onAfter ending the last quarter in a fully defensive posture, Toews models began triggering buys as the markets rallied off…

Phil Toews’ Appearance on Cheddar TV

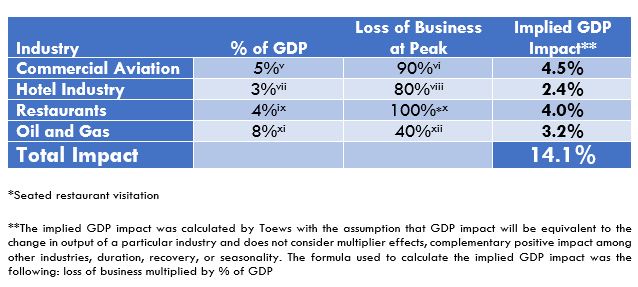

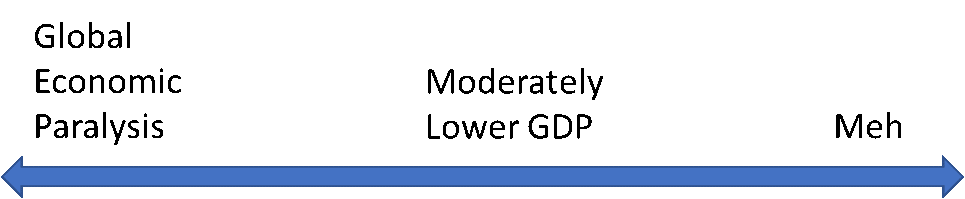

In Market Analysis, Media Appearances onNote: Toews’ opinion regarding future GDP growth is not determinative.

Aiming to Bring the Quantitative and Qualitative back in Sync

In Market Analysis onRecent market turmoil followed by gains left some investors confused about where to go from here. Buying into risk assets…

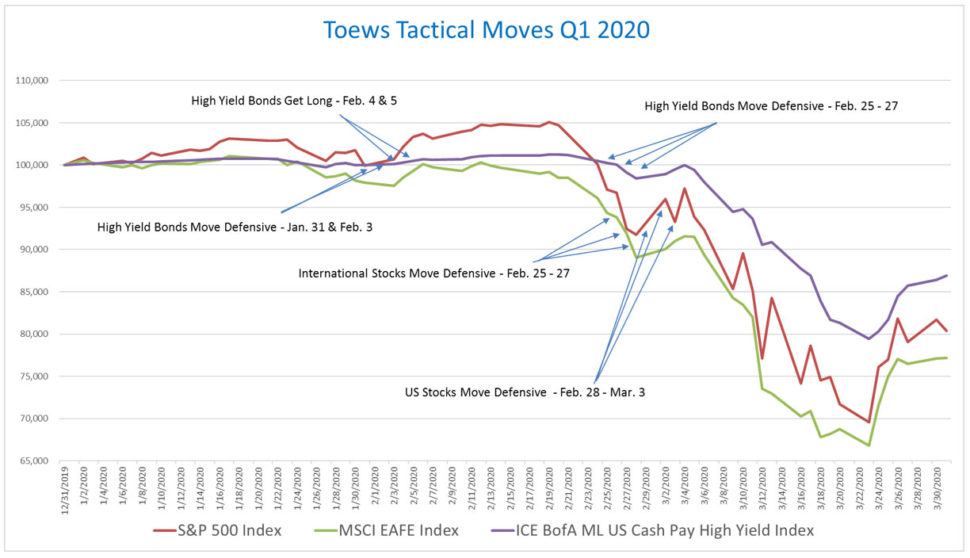

Toews Fully Defensive in Q1 as Coronavirus became Global Pandemic

In Market Analysis onIn January, when cases of COVID 19 appeared to be increasing exponentially in Wuhan, financial markets around the globe began…

Phil Toews on TD Ameritrade Network’s Market Overtime show

In Market Analysis onPhil Toews discusses positioning portfolios for adversity on TD Ameritrade Network’s Market Overtime show amid Coronavirus-related market turbulence.

Getting Real about the Possibilities Ahead

In Market Analysis onPosition Update Toews remains fully defensive across all asset classes.i Additionally, certain equity-containing strategies hold aggregate bond positions, which have…

The Prospects for a Global Pandemic

In Market Analysis onAs equity and high yield bond markets decline in the face of a potential global pandemic created by the coronavirus,…

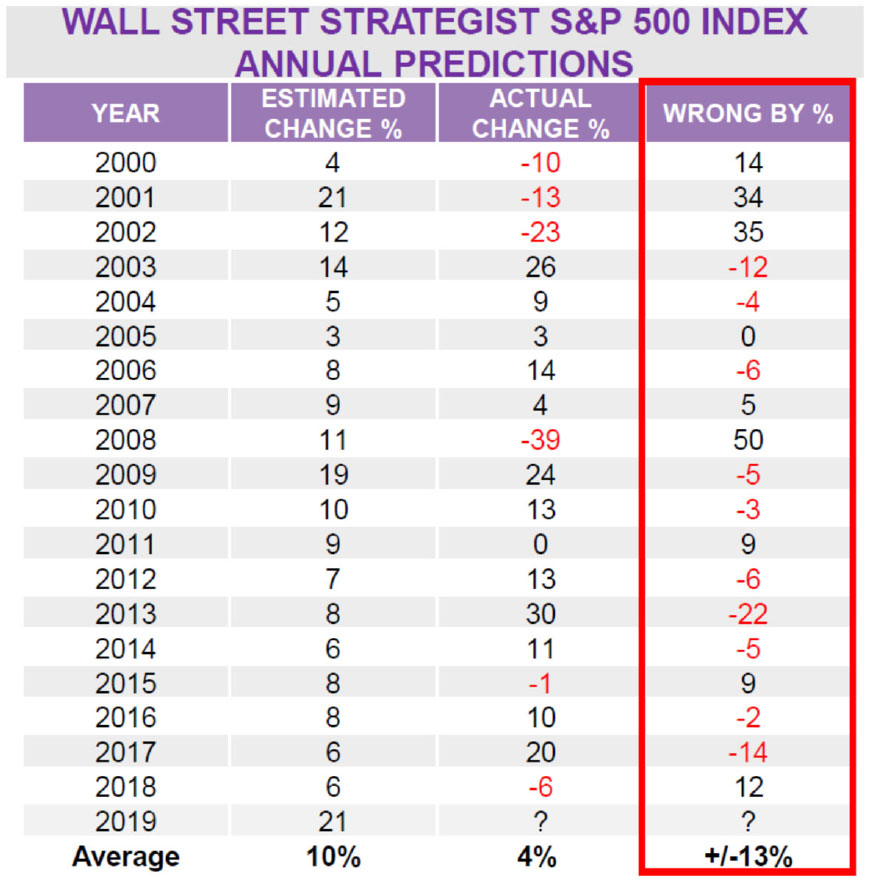

Risk Tracks Higher in 2019 as Investors See Gains

In Market Analysis onIn our last quarterly commentary, we discussed how difficult predicting recessions is, even for professionals. That was the case for…

Predicting Recessions is Hard and Often Unsuccessful

In Market Analysis onData continues to suggest that the U.S Economy is slowing. The September U.S. manufacturing purchasing managers’ index showed its lowest…

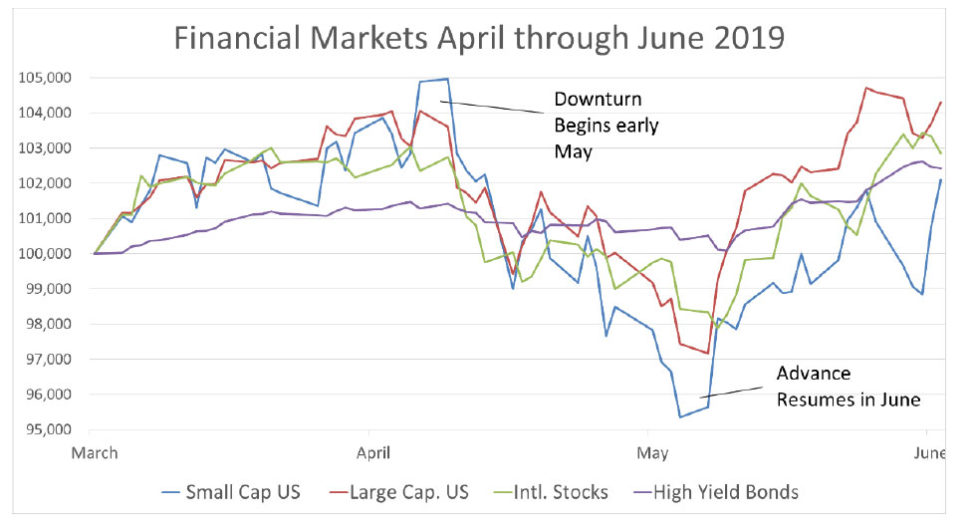

Recession Indicators Mount against Rising Markets

In Market Analysis onThe second quarter began with gains following a strong first quarter. Markets turned lower in May in response to deteriorating…

Opportunities for Tactically Managed High Yield Bonds in 2019

In Market Analysis onEquity Valuations Remain High Prospects for High Yield Bonds Improve Tactically Managed High Yield Bonds Potentially Uncorrelated during Equity Declines…

US Joins Global Equities in Downturn

In Market Analysis onThroughout much of the third quarter global equities declined in unison with one exception: U.S Stocks. For the week of…