In 1999, after one of the biggest bull markets of the century, advisors seemingly abandoned caution. Despite their stratospheric valuations, assets flowed into growth and technology stocks and out of risk-managed and value funds. Investors who earned only 20% likely complained wildly to their advisors that they had only captured a fraction of the Nasdaq Composite return which gained over 85% that year.

Again, in 2007 and early 2008, our firm witnessed more transfers from risk managed portfolios into always invested equities than we had ever seen before, even as markets had already begun to roll-over.

Although it seems unthinkable after the financial crisis, we are again seeing some advisors increase their allocations to strategies that remain fully invested with increased risk of market losses, even as we move into the 10th year of a bull market. We don’t claim to know if the bull market is over, but we believe that we are at or near the peak number of capitulations for risk managed strategies.

People surrender to their emotions at both market extremes. Near or slightly after market bottoms, investors express their dissatisfaction with stocks by wanting to abandon anything that experienced severe market losses. Investors seemed to express that they were no longer concerned with gains, they just didn’t want to lose any more money. When people want to get out, keeping investors in stocks is difficult, and hard to justify. Moving to more secure strategies seems wise and obvious.

Near market tops, advisors and their investors see the same “wise, obvious” truth in reverse.

Advisors act with anger toward strategies that have trailed markets. They waste no time allocating into investments that have performed better recently and may have less robust loss avoidance mechanisms, or worse, no capacity to avoid declines.

Behavioral Portfolio Management means doing the opposite and taking advantage of the crowd’s poor decision-making abilities. Unfortunately, when behavioral portfolio management is the most beneficial, it is also the hardest and most counter-intuitive to execute. We believe that now may be a moment when acting against the crowd and your own intuition could be a career-defining move.

Avoiding a Tariff-Related Sell-off a Prime Directive for Advisors this Quarter

We prefer to never predict what will happen, but framing issues in their historical context helps us understand the potential risks and rewards to our investors. And we believe that the potential escalation of tariffs combined with rising rates present a formidable risk for advisors and their investors in the second half of 2018.

The first thing to consider is the environment in which this is playing out. The backdrop for the news on tariffs is an over-valued market. When assets are over-priced, as we believe they are, their inevitable path is to return to mean valuations. There are two ways that that happens: company earnings increase, while prices stagnate; or, more painfully, stocks lose value and return to fair valuations.

When stocks are priced for perfection, ideally things will remain…perfect. But history shows that the prospect of a major trade war, unthinkable by a Republican adminstration a few years ago, may be consequential. In other words, far from perfect.

We see two divergent potential outcomes, one optimistic, the other pessimistic, but both very real possibilities depending on how the tariffs are eventually resolved.

First the optimistic case: In the days after announcing tariffs on an additional 1,300 products, or over $50 Billion in imports, the NEC Chief Larry Kudlow expressed a hopeful perspective. When asked what the probability was of implementing new sanctions, he responded that it was not zero, but the president is at heart a free-trader. At about that same time, the stock market reversed course and headed higher. The implication is that negotiations prior to the escalation of tariffs may accomplish exactly what the administration seeks: reciprocity in trade and an agreement by China to discontinue intellectual property theft.

If that eventually happens, the tariff issue that hangs over the market disappears. There would also be an enormous boost to the credibility of the adminstration, which took a huge risk and achieved something that, for decades, no other administration had been able to.

Now the pessimistic case: Mr. Zhu, the Chinese Vice Minister of Finance, outlined the terms for negotiations, which he suggested were “…the removal of the United States unilateral tariffs and a resolution of any grievances through the World Trade Organization”. (1) The Chinese government, through state-run media, is clearly conveying its resistance to pressure to change its policies as a result of tariffs, saying, “China is not afraid of a trade war.” The stance that China will be resolute in not being forced to change their policies by tariffs is pervasive in China. In other words, drop the tariffs, and we’re happy to negotiate with you; continue the tariffs, and we’ll fight back.

If the Trump adminstration continues to be unwilling to remove the tariffs unless China makes meaningful policy changes, and China makes good on its threat to refuse to negotiate unless tariffs are removed, it seems likely that further tariffs will be enacted, and that neither player will be able to back down without openly admitting defeat.

What then? According to U.S. Commerce Secretary Wilbur Ross, the value of proposed Chinese tariffs represents only .3% of US GDP. However, Yale Economist Robert Shiller has pointed out that the most significant trade war of all, precipitated by the Smoot Hawley Tariffs, may not have had much of a direct effect on GDP but lowered investor confidence and prevented future purchases and planning. (2)

It’s hard not to look back to the Smoot Hawley Tariffs for comparison. They were put in place in 1930 and are pointed to as one of several key factors that may have caused the Great Depression.

The resilience of U.S. markets until now is based on a belief that the administration will make a deal and prevent an escalation of conflicts. If that changes and a majority of market players conclude that the adminstration won’t strike a deal, everything changes, and there may be little time to adjust to this new market paradigm.

Advisors tend to sense that they can adjust portfolios if the market changes. Yet we’ve never experienced a significant market decline that was obvious to spot in the early stages. Instead, once stocks have lost 15% or 20%, many advisors are shell-shocked and without clear options. To exit or incorporate loss avoidance strategies at that point potentially means locking in losses. Failing to deploy risk-management makes investors vulnerable to further declines.

When might a decline occur? As we mentioned, peak capitulation from risk-managed strategies often occurs even as markets have already begun to decline (we saw peak departures from our unconstrained strategies in the first quarter of 2008, as we were about to have one of our best outperformance years). Losses in U.S stocks in the past month have been limited, but international stocks are already under pressure. The MSCI EAFE index is down from its yearly high by 11%. But the real leading indicator may be emerging markets, which are down from their high this year by 18%, approaching bear market territory. (3)

Your Practice in the Face of Market Losses

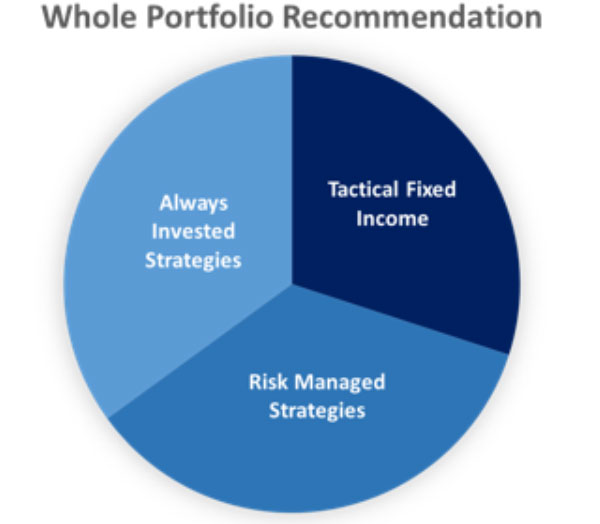

What is your exposure to market losses? Are your clients ready, are their portfolios ready, is your practice ready for losses? Of the stocks in your investors’ portfolios, what is the expected drawdown as a percent of market declines? Our whole portfolio recommendation is to place half of your equity exposure into risk managed strategies that attempt to provide robust loss avoidance during market disruptions. Advisors with insufficient allocations to risk managed strategies need to recognize that they are making a market bet that the bull market will continue its stretch into its tenth year, and that a trade war will be avoided. If that bet is wrong, it could threaten your practice.

There are other variables that are not considered in the above chart that could affect the market’s movement, portfolio performance and/or the state of your practice.

The wisdom in our whole portfolio recommendation is that you’re not making a bet one way or another. If markets do continue to advance, it positions you to potentially capture gains with both the always invested and risk managed strategies. If, however, we do experience a market decline, you are potentially poised to avoid losses and capture rebounds with your risk-managed portion of your portfolio.

There are other variables that are not considered in the above chart that could negatively affect the market’s movement, portfolio performance and/or the state of your practice.

How Each of the Toews Strategies Attempt to Lessen Losses

Toews Unconstrained Strategies

These portfolios move from attempting to track stock and bond indices to cash or short duration bonds as prices start to move lower. The strategies seek to re-enter markets once they start to rebound.

Because the strategy exits to cash, it is vulnerable to market underperformance if markets turn higher when the portfolios are in cash, but it also may be the least likely to experience extreme losses.

Toews Defensive Alpha Strategies

Our defensive alpha strategies attempt to provide a reliable way to participate in market gains. These portfolios seek to move into defensive stocks when prices start to decline, potentially reducing losses while remaining fully invested.

Because the strategies remain fully invested, they are vulnerable to losses. However, due to their ability to allocate into defensive stocks, the strategy may be less vulnerable to losses than the market as a whole.

Toews Tactical Fixed Income Strategies

Our tactical fixed income strategies, including our flagship High Income Portfolio, is designed to adapt to negative market environments. High yield bonds may have a higher yield than other bonds (currently near 5%). High yield bond returns may be correlated with equity returns during certain market cycles, potentially producing concrete gains. Such potential for gain comes along with the potential for risk, however. Our fixed income strategies attempt to manage that risk.

Our tactical models attempt to allocate out of high yield bonds or aggregate bonds during declining markets and participate in rising markets. Due to the relatively low volatility of high yield bonds when compared with stocks, tactical high yield bonds are less susceptible to underperformance from whipsaw markets.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

This document refers to the performance of the majority of Toews portfolios to illustrate the effect of Toews management on US and intl. stocks and high yield bonds. Performance of individual accounts varied based on the client’s investment risk profile and their specific investment funds. For your individual account performance, please refer to the enclosed quarterly statement or the quarterly statement recently sent to you. In addition, not all model portfolios were referenced in this letter. It is not, nor is it intended to be, a comprehensive accounting of Toews asset management. There are other portfolios that Toews manages that performed differently than what is referenced in this letter. For a complete list of GIPS firm composites, their performance results and their descriptions, as well as additional information regarding policies for calculating and reporting returns, please go to www.toewscorp.com. Toews Corporation acts as the investment advisor that implements the asset allocation and models for each of the portfolios. Investors cannot invest directly in an index.

(1) Myers, S.L. (2018, April 05). Why China Is Confident It Can Beat Trump in a Trade War. Retrieved April 06, 2018, from https://www.nytimes.com/2018/04/05/world/asia/china-trade-war-trump-tariffs.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=first-column-region®ion=top-news&WT.nav=top-news

(2) Fox, M. (2018, March 02). Trump’s tariffs ‘like a first shot in a war’: Nobel-winning economist Robert Shiller. Retrieved April 06, 2018, from https://www.cnbc.com/2018/03/02/trumps-tariffs-like-a-first-shot-in-a-war-economist-robert-shiller.html

(3) Source of Data: Bloomberg, accessed 07/10/2018.