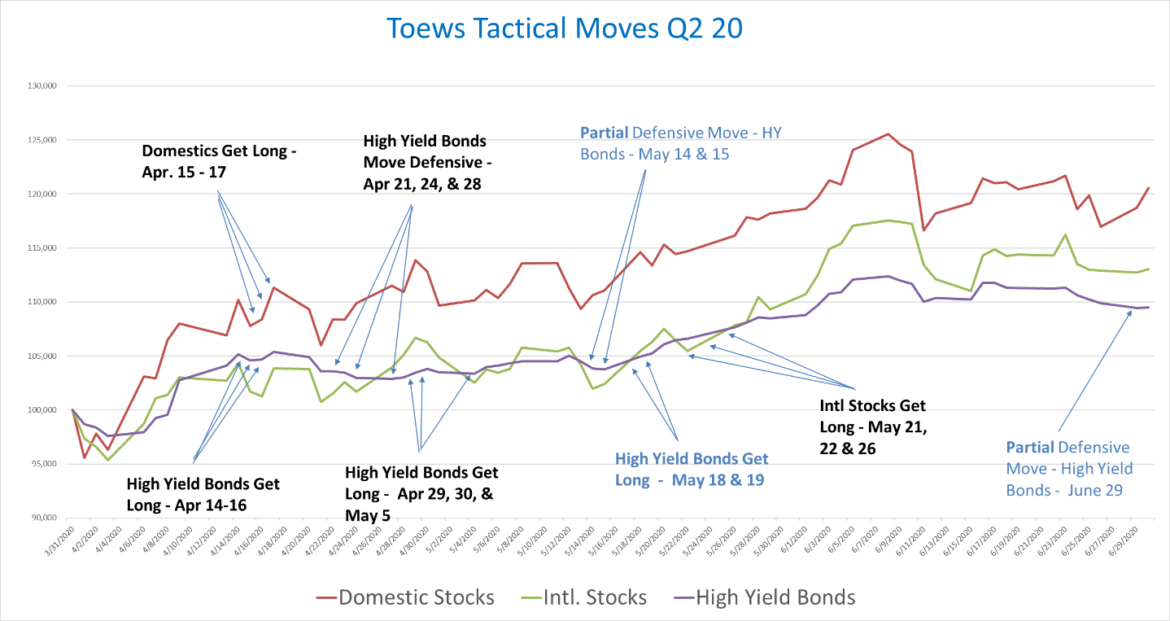

After ending the last quarter in a fully defensive posture, Toews models began triggering buys as the markets rallied off of the lows of late March. Between April 14 and April 17 we moved to a bullish posture in US Stocks and High Yield Bonds, and on May 26th we completed our move to bullish positions in International Stocks. We’ve remained in a bullish posture in US and International Stocks. We’ve had several partial[i] exits and re-entries from High Yield Bonds and are currently in a bullish position.

Prior performance is no guarantee of future results. Investors cannot invest directly in an index. Source of Data: Bloomberg Financial, L.P. Accessed 7/6/2020. The illustration above only reflects the High Yield Bond, International Stock, and US Stock exposure of some Toews strategies and does not include the moves of all asset classes within Toews strategies. Other Toews strategies did not move as described. The moves only reflect iVest and Synthesis Investments accounts at TD Ameritrade and TAMPs that are invested in Toews mutual funds; there may be other accounts that did not move in this way (both TAMP and Separately Managed Accounts). Domestic Stocks refers to the S&5 500 Index, the Intl. Stocks refers to the MSCI EAFE Index, and the High Yield Bonds refers to the ICE Bank of America ML Cash Pay High Yield Index. The moves described only apply to asset classes as opposed to a particular index.

A goal of our investment methodology is to potentially capitalize on declines that last for a month or more. A decline can create the opportunity for a gain that we otherwise would not have been able to realize. If markets fall, keep this goal of our strategies in focus.

Three Bear Markets to Test our Philosophy

After a presentation I gave in 2003 (following the internet stock crash and subsequent advance), there were some questions about whether or not Toews method was to try to “predict” the market over the prior 4 years. My explanation was that we believe that a key to managing risk is to not attempt to predict the markets. Instead, we react to price moves based on rigorously researched trend following algorithms.

I can think of no market move that was more difficult to predict than the advance that we’ve seen over the past few months. In the face of double-digit unemployment and a contracting GDP, stocks have recovered nearly all of their yearly losses, with the NASDAQ Composite index setting an all time high over the past week. At the time that we began moving to a bullish posture on April 14, our investment management team was deeply negative about the prospects for stocks. Yet, by following our process, we bought stocks anyway, resulting in market participation as the market roared higher in the past quarter.

The recent bear market is the first in a decade. Investors who are new to our strategies were able to see for the first time how our system reacted to a very rapid market decline. This downturn marks the third bear market that we’ve experienced in some of our strategies since we began managing them in 1996, and it demonstrates our approach to managing risk through varied market cycles.

Suspended Disbelief at the Market Advance

Suspension of disbelief is “an intentional avoidance of critical thinking or logic in examining something surreal, such as a work of speculative fiction, in order to believe it for the sake of enjoyment[ii].” Most of us experience this for the first time when seeing a magic act. With a super skilled magician, as we witness the impossible, for a brief moment we think, can it really be magic?

Many investors may be in suspended disbelief (us included) at the resilience of the stock market in the face of the first recession in ten years: Is the stock market correct, and is the economy is actually healthy? Can stocks move despite all circumstance?

For those still in suspended disbelief we have news: We have found the man behind the curtain, and he is us (investors). Short term stock advances that are not supported by fundamentals may be nothing more than positive momentum begetting more positive momentum. Within the framework of markets that are efficient over the long term there are many examples of short-term mispricing moments that have been inexplicable and extreme.

Framing the Crisis: Market Euphoria or a Depression?

Retaining any gains from the past quarter and any further advances is of course possible, but we believe that it will depend on a rapid rebound in the economy over the coming year. The optimistic scenario is that social distancing and medical treatments are effective at reducing infections this year and a vaccine is successfully produced by the end of 2020. Under this scenario consumers could come back with vigor and fuel growth across the economy.

The pessimistic scenario is that COVID-19 cases continue to increase in the US as states re-open, a second and even more fierce wave comes to the northern hemisphere as students return to school, and/or an effective vaccine isn’t realized in the first half of 2021. Under this scenario, GDP contraction and elevated unemployment could cause systemic crises, additional company bankruptcies, and banking and financial crises, even raising the possibility of a depression.

When we advise investors, we talk about contingency planning. That means positioning portfolios to potentially address either scenario:

- The key is not if markets are moving down, but are you prepared for it.

- Don’t leave the market, and don’t bet against it. Hedge. Do this by investing in strategies that are designed to attempt to participate in gains but also attempt to uncorrelate from market activity if stocks turn south.

- Include a significant allocation to these strategies in line with your risk tolerance to potentially reduce the risk of drawdown.

- Even though some technology stocks have done relatively well, don’t forget February and March of this year. If the market enters a free-fall, it potentially affects all sectors. Even if it doesn’t make sense, everything can fall together. It can turn into a panic.

- At 11% unemployment, focus your efforts on attempting to manage risk, not speculating on specific parts of the market

We are Here to Attempt to Help You Manage Risk

Our investors have many issues related to the Coronavirus Crisis, including their health, their jobs, their incomes, and the viability of their businesses. At these times, it can becomes even more important that your portfolios attempt to manage risk. Toews strategies were conceived with the objective of attempting to help navigate extreme and unexpected markets. Over the coming year, it is highly likely that news at times will cause investors anxiety. Remember, however, that at Toews, we have a plan in place to attempt to address falling markets.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

The ICE Bank of America Merrill Lynch US Cash Pay High Yield Index has been used as a comparative benchmark because the goal of the above account is to provide bond-like returns. The index is generally used to measure market performance of fixed-rate, coupon-bearing bonds with an outstanding par of greater than or equal to $50 million, a maturity range greater than or equal to one year and must be less than BBB/Baa3 rated but not in default.

The MSCI EAFE Index is an index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance of large and mid-cap securities in developed markets in Europe, Australia and Southeast Asia, excluding the U.S. and Canada.

The Nasdaq Composite Index is a large market-cap-weighted index of more than 2,500 stocks, American depositary receipts (ADRs), and real estate investment trusts (REITs), among others.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

[i] Partial moves are defined as moves into or out of an asset class that did not completely enter or exit the asset class.

[ii]Source of Definition: https://en.wikipedia.org/wiki/Suspension_of_disbelief#:~:text=Suspension%20of%20disbelief%2C%20sometimes%20called,for%20the%20sake%20of%20enjoyment., retrieved on July 8, 2020.