As equity and high yield bond markets decline in the face of a potential global pandemic created by the coronavirus, advisors and investors may be faced with the real prospect of a potential dramatic economic event that has already affected China and may be exported to the rest of the globe. We’re writing this to discuss Toews strategies in the context of different potential outcomes from the spread of the virus.

The coronavirus is a human tragedy that has caused thousands of deaths and potentially many more. The economic effects of the virus are realized from both the physical tangible risk and potentially even greater from fear associated with its spread.

Over the weekend, videos from Beijing (not in the Wuhan district that had been the focal point of the virus) surfaced that showed normally crowded sections of the city virtually empty. Travel to, from, and within China has been dramatically curtailed or eliminated. People with an IQ higher than 30, immediately visualize that potential reality projected over broader Asia (Korea has been affected), Europe (Italy is seeing an outbreak), and potentially the United States are rightfully concerned. Historically, economic paralysis, even if temporary, has not been a productive environment for financial assets!

Potential effects of Options, Aggregate Bond Underlay, and Exits

Just last week, the S&P 500 Index set a new all time highi. Yet, today, the Dow is down over 1,000 pointsii, with some investors fearful about additional losses if the crisis mounts. Moves this fast typically don’t allow our algorithms time to exit into a defensive posture. However, in 2017 we began deploying put options and a tactical aggregate bond underlay strategy in our equity portfolios that potentially help offset sudden downturns. Although other assets have declined, put options have appreciated today and aggregate bonds were up over 0.35%iii when we wrote this update.

Investing in our strategies could possibly allow you to avoid making the call about whether the fear of an event justifies a portfolio shift. We’re doing that already under a systematic methodology that is devoid of subjectivity and behavioral biasesiv. Once our algorithms indicate a sell we will begin exiting into a defensive posture.

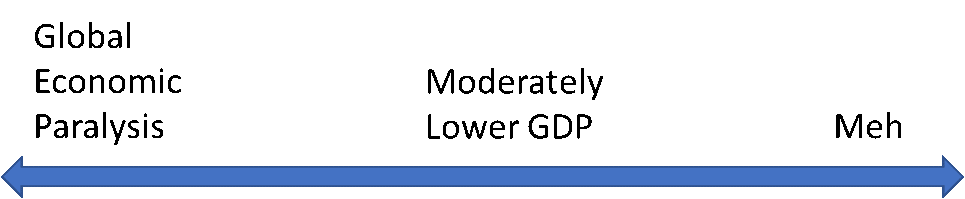

Global Pandemic, Moderately Lower GDP, or Meh?

It’s impossible to know what direction the markets will take. An extreme scenario would be that the type of slow-down seen in China comes to the United States and the rest of the world, and lasts not just weeks, but several months. Under this scenario, a significant market reaction may be realized. Should that be the case, our strategies may move to a defensive posture as market turmoil plays out.

On the other end of the continuum, the panic associated with the market may prove to be unjustified. In such an event, the spread of the virus recedes, and the markets may strongly rebound. In that case, our algorithms are designed to attempt to remain in or re-enter markets to attempt to participate in gains.

Regardless of what happens, understand that our strategies were explicitly built to attempt to help investors navigate market turbulence. We’ll update you as our posture evolves.

Best,

Phillip Toews, President/CEO

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This message may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation. This document refers to the performance of the majority of Toews portfolios to illustrate the effect of Toews management on US and intl. stocks and high yield bonds. Performance of individual accounts varied based on the client’s investment risk profile and their specific investment funds. For your individual account performance, please refer to the enclosed quarterly statement or the quarterly statement recently sent to you. In addition, not all model portfolios were referenced in this letter. It is not, nor is it intended to be, a comprehensive accounting of Toews asset management. There are other portfolios that Toews manages that performed differently than what is referenced in this letter. For a complete list of GIPS firm composites, their performance results and their descriptions, as well as additional information regarding policies for calculating and reporting returns, please go to www.toewscorp.com. Toews Corporation acts as the investment advisor that implements the asset allocation and models for each of the portfolios. Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by writing to Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or by calling (877) 863-9726.

________________________________________

i Hajric, V. (2020, February 18). Stocks Reach Record Highs After China’s Moves. Retrieved from https://www.bloomberg.com/news/articles/2020-02-18/asia-stocks-futures-mixed-after-u-s-shares-slip-markets-wrap

ii Bloomberg (2020, February 24). Retrieved from https://www.bloomberg.com/news/videos/2020-02-24/stocks-sink-dow-drops-as-much-as-1-000-points-video

iii Based on AGG and BND, which track the Bloomberg Barclays US Aggregate Bond Index. Source: Bloomberg Financial L.P. Retrieved 2/24/2020.

iv This refers to our algorithm. However, discretion may also be used.