After rallying nicely during the summer, markets turned south in September and finished the quarter at fresh lows for the year. We were invested in most of our strategies during part of the summer, but turned defensive again in September, and are currently fully defensive across our platform.

In this commentary I’ll discuss opportunities that are emerging as markets continue to fall. I’ll also examine the impact of bond losses on conventional 60/40 portfolios. Finally, I’ll look at some of the remaining challenges that face stock and bond markets as we enter the final quarter of the year.

BONDS FAIL TO BOLSTER CONVENTIONAL PORTFOLIOS

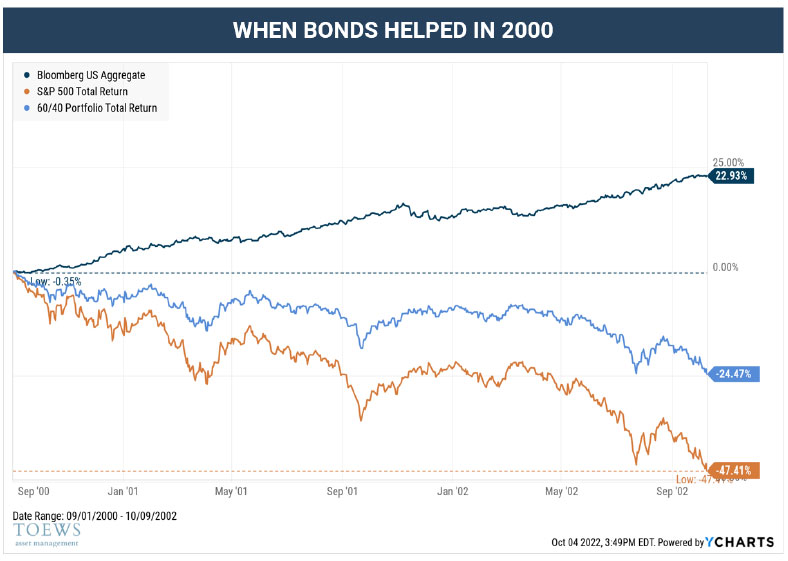

For over four decades investors have relied on an inverse relationship between bonds and stocks to help lessen losses during market crises. When stocks fell, assets historically shifted to bonds. At the same time, the Federal Reserve tended to lower rates during stock market routs, causing bond prices to rally. For holders of conventional portfolios, this meant that stock losses were blunted by bond gains.

For example, in the long duration bear market following the internet stock bubble, as stocks lost over 47%i between September of 2000 and October of 2002, bonds increased by 23%, causing a 60/40 portfolio to lose just 24.5%.

Again, during the financial crises, bonds saved the day. As stocks fell a brutal 55% over 16 months, bonds gained 7%, and a balanced portfolio lost 35% (20% less than stocks fell).

This year, by contrast, as stocks fell 24% through September, bonds have lost 14.6%, causing a balanced portfolio to lose 20%, just 4% shy of the loss in stocks.

If the Federal Reserve continues to raise rates, it’s possible that the loss in bonds will continue while stocks fall further. The implications are that with similar stock losses, conventional balanced portfolios could fare much worse than they did in either the internet stock implosion or the financial crisis. The primary message we have for investors is: think unconventionally. While passive investing in index portfolios worked well over the past 10 years, the current market leaves investors vulnerable to life altering losses.

ONCE MARKETS BOTTOM, THE REBOUND COULD BE SUBSTANTIAL

As pessimism reaches ever higher levels, it’s important to keep focused on the ultimate outcome, which will likely be a strong rebound once markets finally bottom. In fact, the more extreme market declines become, the more extreme the market rebounds may be. In the nine prior instances of bear markets where the Dow Jones Industrial Average fell 30% or more, the following bull markets averaged gains of 121%. If investors can avoid part or even a majority of market declines but are able to participate in a portion of the following rally, it’s possible to benefit (realize gains) from the decline. In other words, investors can gain from market dislocations by participating in rebounds that might not have occurred if the bear market never happened.

Past performance is no guarantee of future results. Source of Data: Bloomberg, access 09/14/22. The Dow Jones Industrial Average Index is an unmanaged index generally representative of the U.S. bond market. It is not possible to invest directly in an index.

DATA SUGGESTS THAT THE BEAR MARKET WILL CONTINUE

Despite a brutal first nine months of year, several metrics suggest that we still have a way to go (lower). First, it’s fairly clear that the Federal Reserve will continue to tighten monetary policy for the next 3 and likely six months, putting further pressure on both stocks and bonds. Stock market valuations are still high, and are part of an everything bubble that we’ve been talking about over the past year. One way to express this all-asset bubble is to look at household net worth relative to GDP. In a normally valued market, the growth in household net worth would equal the growth of the economy. Recently, however, household net worth has increased significantly more than GDP (as it did during the last to market bubbles). Mean reversion of this statistic has broad negative implications for assets that includes stocks as well as home prices.

Working to help pop the bubble is the Federal Reserve Bank. Declining asset prices and lower employment are tools that help bring down inflation. Betting for a stock market rally from here means betting against the FED, a strategy that has historically been unwise and unprofitable!

Despite the heavy weight of evidence suggesting further declines ahead, we suggest that you avoid making outright market calls. Instead, attempt to remain invested but address the contingency that both stocks and bonds may fall further by taking these steps:

- Place half of your stock portfolio into hedged equity or high conviction tactical portfolios in an attempt to address potential stock market losses.

- Move fixed income portfolios into adaptive or unconstrained strategies that attempt to mitigate the effect of rising rates or inflation.

Taking this approach may not only help lessen losses during a chaotic market, it may allow investors to potentially capitalize on market dislocations by positioning them to sidestep a portion of declines and capture rebounds that follow. Less sexy than getting rich without really trying, the current objective may be attempting to “not get poor without really trying”.

Disclosure:

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends.

The Bloomberg Agg Index measures the performance of investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. It rolls up into other Bloomberg flagship indices, such as the multi-currency Global Aggregate Index and the U.S. Universal Index, which includes high yield and emerging markets debt.

Dow Jones Industrial Average Index is a financial index that is widely used to evaluate the overall performance and health of the stock market. It consists of 30 stocks picked by the editors of the Wall Street Journal.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.