Current Positions:

High Conviction Tactical Models*1:

Developed International Stocks: 100% Cash Instruments

High Yield Bonds: 100% High Yield Bonds

US Stocks: 100% Cash Instruments

Investment Grade Bonds: 100% Cash Equivalents

Equity Portion of Defensive Alpha Models*:

100% Defensive Posture†

Recent Trades

Our algos moved us into an invested position for our High Yield Bonds allocations across our models. We began scaling into these positions on Thursday and completed the trades yesterday near the close. All other assets remain in a defensive posture.

Our strategies tend to move early during trends. That means that we could have traded into High Yield near the bottom. If this is another bear market rally, expect for us to trade out again quickly.

Our strategy has been effective at meaningfully limiting bond losses this year in our view. We’re prepared to attempt to continue that trend moving forward.

Market Environment

The declines during the second quarter were relentless, with the stocks suffering seven consecutive down weeks before beginning the recent rally. A rebound from those over-sold conditions was not unexpected. However, we’re all aware that there are still numerous threats to a continued advance.

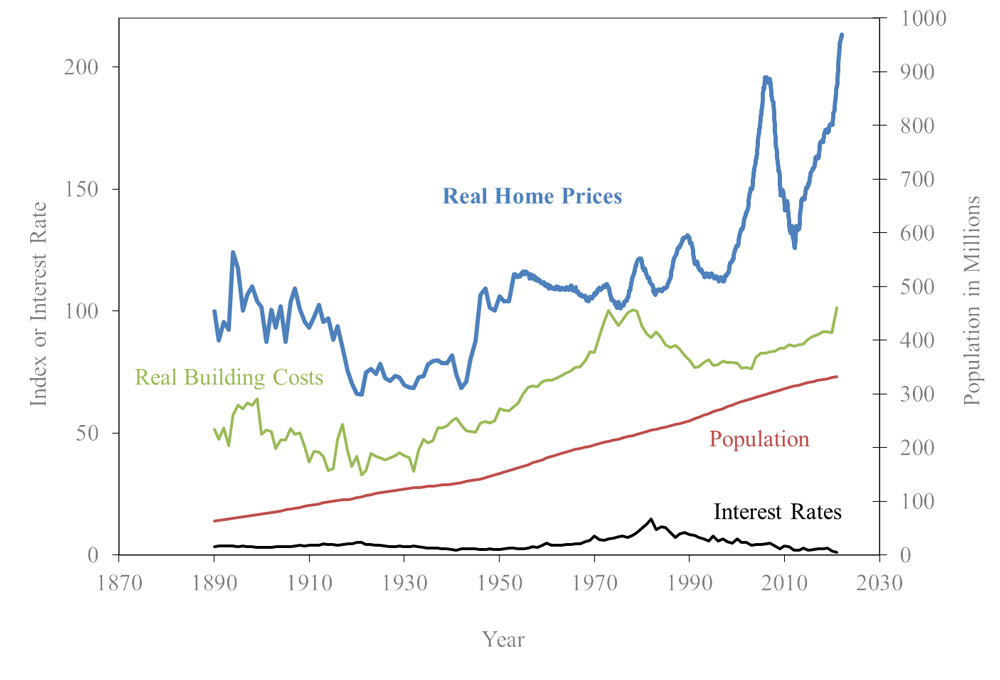

Chief among these threats is continued bubbelicious valuations across a broad swath of assets. There is still 1.25 trillion in market capitalization held in digital tulip bulbs (crypto-currencies). And stocks total market valuation compared to GDP is higher than at any point in history prior to this recent rally. But few graphs illustrate the situation more effectively than the historical real home price index built by Robert Shiller and Karl Case, showing that real home prices are in a bubble that exceeds what we saw even in 2007.

Source : http://www.econ.yale.edu/~shiller/data.htm

In order to tackle inflation, the FED needs to pop these bubbles. That means introducing what appears to be a nearly unprecedented level of quantitative tightening, causing a continued drop bond values, further stock declines, falling house prices and, potentially, a recession.

We encourage advisors to remain open minded about the possibilities for market dislocation over the coming year. We are focused on attempting to manage through rising, declining or even chaotic markets ahead.

We’ll update you with any additional trades ahead.

Toews Management Team

All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice, and no representation is being made as to whether the information provided herein would be beneficial for any or for a specific Employer Benefit Plan or investor.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

(1)These include the Toews Capital Preservation, Balanced, Balanced Income, Balanced Growth, Growth, and All Equity, High Income, Balanced Income, and Conservative Income portfolios. They do not reflect the allocations of these strategies that are not allocated to Toews Funds.

(*)Exposure to vehicles invested in the listed asset classes

(†)Approximate Defensive Allocation