Investing can be like walking through a dense forest with no map, and no ability to see the sun. Trees and landmarks, all that we can see, collectively obscure the path ahead. Only by ascending above the tree line can one get an understanding of the broader landscape.

When investing, each factoid (unemployment, GDP, earnings, interest rates) provides what feels like essential data, but may collectively overload us with information and blind us to broader and sometimes central realities.

GDP growth is higher than it has been in over a decade, employment is improving, and interest rates remain at generational lows, creating what appears to be a fertile environment for stocks. But two of the last three recessions (internet burst, financial crisis) were not caused by a deteriorating economy, but by collapsing financial assets.

Historically, the way to ascend above the tree line of economic noise has been to look at market valuations. Although it’s difficult to use valuations to know what will occur over the very short term, they’ve been a reasonably good way to determine the probability of market gains, but also stock market crashes.

WHEN P/E RATIOS WERE HIGH IN THE PAST, DID STOCKS CRASH??

Currently, trailing twelve-month earnings are for the S&P 500 are 27 (meaning that we pay $27 for every dollar of company earnings). The average is about 15.

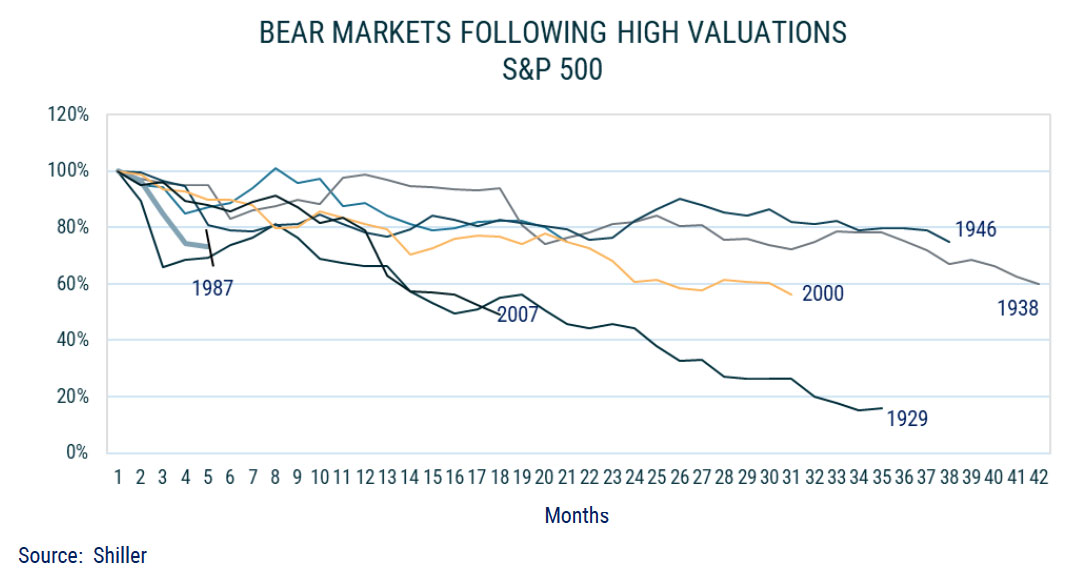

What has been the outcome in the past when stocks ascended to these levels? We evaluated the data looking back to 1900, and the numbers are striking. Twelve-month trailing price/earnings ratios exceeded 20 only 9 times in the past 121 years.i Seven out of those nine times elevated valuations led to bear markets. The average decline was 42% and lasted on average just over two years. The two instances when valuations moved above 20 and did not lead to a bear market was in 1991, when P/E ratios became elevated, but stocks grew their way back to more normal levels, and briefly in 2004, when P/E ratios moved above 20 for several months before receding.

With P/E ratios at 27 times earnings, that puts us higher than at any time in history except during the speculative internet bubble and when earnings got crushed during the financial crisis. That means that our only reference point for current valuations is the internet bubble burst that saw stocks decline 44% over 2.5 years, with NASDAQ stocks, the stocks that had advanced the very strongly, not recovering from losses for over a decade.

THE FED AND THE MARKETS

We believe that the FED’s current ability and willingness to act in the face of declining financial asset prices is limited to non-existent, and that investors have yet to recognize the effective end of the FED put. Unlike 2000 and 2007, when the 10 year yield was 6.7% and 4% respectively, that yield currently stands at near generational lows of 1.5%ii. The Discount and Federal Funds rate are already bottomed out, and the FED is buying $80 billion of securities per month, putting it in a mode of near maximum accommodation. Although the FED has signaled that it’s on a trajectory to reduce asset purchases, they have not yet done so. All of this renders the Federal Reserve with significantly less potency than in prior elevated markets.

But perhaps a bigger concern from our perspective is that, unlike the prior two bear markets mentioned, inflation has become a real consideration. The Federal Reserve has dual mandates: helping to avoid recessions and move towards full employment and managing inflation. With GDP still growing and labor markets improving, we believe that falling asset prices alone will not cause the FED to act, outside of potentially maintaining asset purchases.

Turn back the clock three years to the fourth quarter of 2018. Similar to the recent downturn, markets turned lower and began to build up negative momentum. When the FED failed to respond, and appeared to continue to suggest that they would raise rates, markets went into free-fall. Finally, in December, in response the stock declines, Jerome Powell changed to a more dovish stance, prompting a fierce rally off of the lows of December 24. The question that we would ask is, if the markets repeat this scenario, and inflation prevents the FED from acting, are we vulnerable to a stock market crash?

The answer is an unsatisfying “maybe.” But we believe that the realization by investors of the end of the FED put due to high inflation significantly increases the probability of market a market rout.

COURSE CORRECT TO ADDRESS ELEVATED MARKETS

With valuations and inflation high, act before declines mount to attempt to address the contingency of falling markets. Avoid making markets calls. Despite high valuations, markets could continue to advance to even higher levels. Instead, address the contingency of market losses:

- Invest in hedged equity or high conviction tactical portfolios in an attempt to address stock decreasesduring times of over-valuation.

- Move fixed income portfolios into adaptive or unconstrained funds that attempt to mitigate the effectof rising rates or inflation.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

(i) Source : http://www.econ.yale.edu/~shiller/data.htm Calculations by Toews Asset Management

(ii) Source: https://fred.stlouisfed.org/series/FEDFUNDS