Our strategies moved largely defensive initially in January. Twice since then we’ve moved briefly into markets and back to a defensive posture, where we’ve remained through the end of the quarter. The effect in most cases of this defensive posture has been that, as stocks and bonds have fallen, we’ve avoided a portion of those declines.

The losses were significant enough to become the biggest decline in the first half of the year since the 1970’s for the S&P 500, and the biggest first half decline in history for indices like the Nasdaq Composite and the Small Cap Russell 2000 index (see table below).

Historical First Half-Year Losses i

As we enter the second half of the year, challenges continue to be that inflation remains high and sourcematerials are still near or are setting new highs, the Federal Reserve is stomping on the brakes, and consumer sentiment is plunging. I will discuss each of these separately and present data that illustrates the extremity of some of the challenges ahead. Most of the charts and data come from our recent Economic and Capital Markets update, available for download here. I’ll then discuss what we see as an opportunity for our strategies as asset prices deteriorate.

RAW MATERIALS PRICES SUGGEST INFLATION MAY PERSIST

Every day we hear that “inflation may have peaked.” But data on source of inflation like energy and food are very high or are setting new yearly highs. In the case of energy, rig counts remain low due to a lack of funding because of climate change, preventing additional supplies from coming. High food and energy prices are a problem as these commodities then pass through to other products, potentially forcing broader inflation.

THE FED IS EFFECTIVE, AND IT NOW APPEARS TO BE ACTING TO LOWER FINANCIAL ASSET PRICES

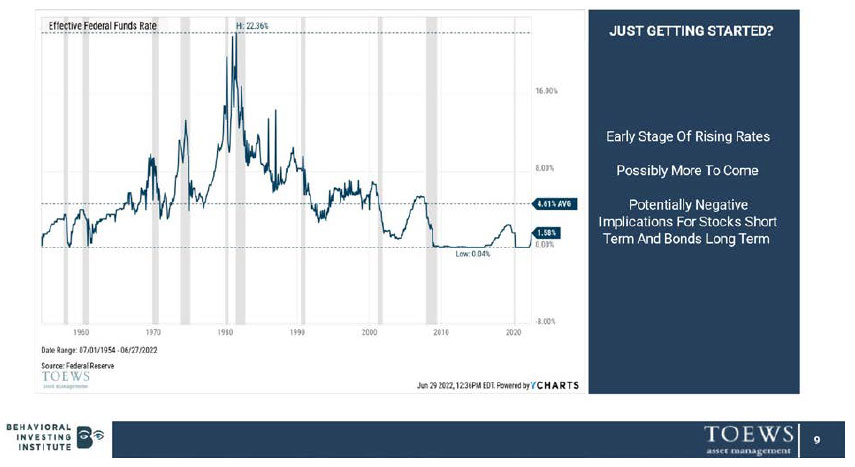

If there’s one conclusion that we’ve reached over the past fifteen years, it’s that the FED is effective at achieving its objectives. Since the financial crisis, it’s provided liquidity and outright asset purchases in the face of deteriorating economic data or declining asset prices. We’ve become accustomed to this support for financial assets. The transition that investors are having a difficult time acknowledging is that now, instead of propping up financial assets, the FED may be acting to cause financial asset prices to decline. Instead of lowering rates as stocks have fallen this year, they’ve embarked on one of the most ambitious periods of tightening that we’ve ever seen, increasing rates as much as .75% at each meeting. By historical measures, it may have only begun. At the end of June, the effective FED Funds Rate was just 1.58% compared to a mean of 4.61% since 1954.

At the same time as the FED is raising rates, it has begun unwinding its massive balance sheet that has grown to 9 trillion dollars since the global pandemic. All of this creates additional pressure on Stock and Bond Prices. The investment grade bond market entered a bear market earlier this year in real terms, having lost over 20% since the beginning of 2021 after considering inflation.

CONSUMER SENTIMENT DIVES LOWER

Potentially because of rising rates, inflation, and declining asset prices, the US index of consumer

sentiment dropped in June to -41.76%, it’s most rapid decline in over 70 years. Declining sentiment can be predictive of recessions.

AS ASSET PRICES DECLINE, OPPORTUNITIES MAY INCREASE

What does it mean when asset prices decrease? If you hold the asset, and experience losses, then you lose wealth. However, if you are effective at avoiding losses, then decreasing asset prices may mean increasing opportunities. Although we feel that the markets have further to fall, as they do, their prices are improving.

During the financial crisis, many of our tactical strategies re-entered markets in March and April of 2009, and were able to participate in a portion of the strong rebound that occurred that year. From that perspective, this decline can potentially be a positive for these strategies.

Despite the heavy weight of evidence suggesting further declines ahead, we suggest that you avoid

making outright market calls. Instead, attempt to remain invested but address the contingency that both stocks and bonds may fall further by taking these steps:

1. Place half of your stock portfolio into hedged equity or high conviction tactical portfolios or funds in an attempt to address potential stock market losses.

2. Move fixed income portfolios into adaptive or unconstrained funds that attempt to mitigate the

effect of rising rates or inflation.

Taking this approach may not only help lessen losses during a chaotic market, it may allow investors to potentially capitalize on market dislocations by positioning them to sidestep a portion of declines and capture rebounds that follow. Less sexy than getting rich without really trying, the current objective may be attempting to “not get poor without really trying”.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

(i) Source: Bloomberg