Markets Gain Further in Q2

After a 6% rise in the first quarter, the S&P 500 Index gained 3% in the second quarter, putting the markets on course to deliver double digit gains in 2017. Other indices also gained, with the Russell 2000 Small Cap Index gaining 2.5% and the International MSCI EAFE Index moving ahead 6.2% 2.

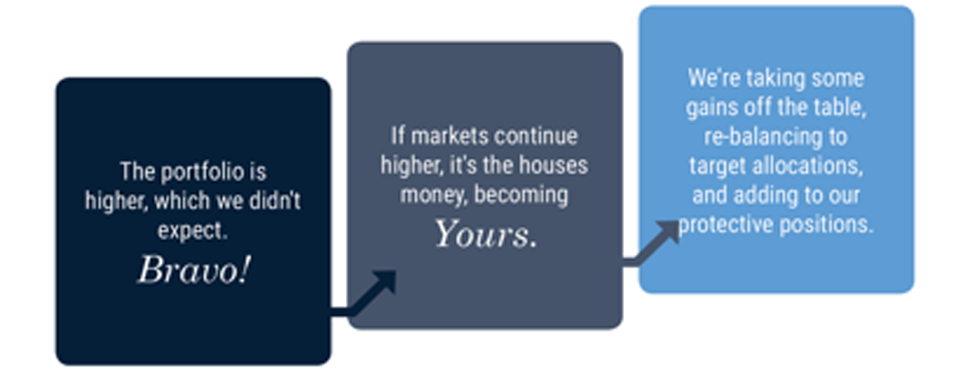

When markets begin the year overvalued, the reaction to further rises is a combination of pleasure and perplexion. We didn’t expect it, we don’t understand it, but we’ll gladly accept it. So what next? The important question is not what we expect the markets will do, but if portfolios are prepared for varied or even extreme outcomes.

When markets stretch higher beyond expectations, our advice is to rebalance portfolios into risk-managed positions, ensuring that portfolio risk management is intact. If markets continue to rise, this strategy will attempt to capture those gains. If they fall, however, the risk management features implicit within Toews strategies aim to lessen drawdowns.

New Element of Risk Management Added across Many Toews Equity Portfolios

The core risk management characteristic across all of our strategies is generated by reacting to prices. Our algorithms interpret the initial stage of a decline and attempt to exit markets before a significant move lower. The models were constructed with extensive market data looking all the way back to the Great Depression.

We were able to satisfy our primary objective, attempting to always be out of the market prior to substantial declines, by analyzing data over vast and diverse types of markets.

However, the question remains: What if a sudden event occurs that causes severe declines in portfolios before Toews’ systems exit (even though historically this has not occurred)? Up to this point, our response has been that we, as well as fully invested strategies, would realize losses.

Over the past few years, our investment committee has researched ways to protect against very low probability market events that, while improbable, would materially affect our investors. As a result of that research, this past quarter we began executing just such a plan across equity portfolios held in Toews Funds.

Due to the way that Toews gains exposure to assets which track stock market indices, we have normally held considerable positions, up to 80% of portfolios, in money market instruments. By attempting to more efficiently allocate those money market positions into higher yielding instruments3, we hope to improve returns on that portion of the portfolio. A share of those increased yields will be used to purchase options contracts that are designed to help protect against sudden market losses.

How Sudden Event Protection is Designed to Work

Put option contracts add a level of protection below market prices. As an example, an investor might purchase put option contracts 10% below the market. That means that those contracts limit losses to 10% during the period in which they are effective. Many investors choose not to purchase options due to their cost and the inevitable reduction their purchase would cause to portfolio returns. This is where Toews has a competitive advantage.

Typically, when we gain exposure to the S&P 500 Index, for example, we purchase Index Futures Contracts that provide full exposure to the market. After purchasing those contracts, we are left with approximately 80% of the portfolio in cash, which, as we stated, we have typically invested in money market instruments. We estimate that, on average, more efficient investment of cash will produce about 3% higher yields than money market instruments. Further, we estimate that options protection will be purchased at an average of 11% below the market. Finally, we estimate that the protection will cost 1.8% per year. So in addition to having a new type of loss avoidance in portfolios, it is possible that portfolios will realize additional returns from these enhancements.

There are a couple of points to consider with this strategy. First, although we intend to maintain some level of option ownership when we are fully invested, the amount below the market will vary based on the cost of options. Although we anticipate an average of purchase price of 11% below the market, it could be greater; and, in some instances, when markets are highly volatile, put options may be too expensive to purchase. Also, the strategy does not affect our tactical fixed income strategies, nor is it applied to our Defensive Alpha strategy when those accounts are in a defensive posture.

We view ourselves primarily as your investment risk manager. There is no shortage of risk in the markets. Our job is to attempt to avoid significant losses. To that end, we are highly gratified to be able to add an element of sudden event risk protection across our equity portfolios.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

This document refers to the performance of the majority of Toews portfolios to illustrate the effect of Toews management on US and intl. stocks and high yield bonds. Performance of individual accounts varied based on the client’s investment risk profile and their specific investment funds. For your individual account performance, please refer to the enclosed quarterly statement or the quarterly statement recently sent to you. In addition, not all model portfolios were referenced in this letter. It is not, nor is it intended to be, a comprehensive accounting of Toews asset management. There are other portfolios that Toews manages that performed differently than what is referenced in this letter. For a complete list of GIPS firm composites, their performance results and their descriptions, as well as additional information regarding policies for calculating and reporting returns, please go to www.toewscorp.com. Toews Corporation acts as the investment advisor that implements the asset allocation and models for each of the portfolios. Investors cannot invest directly in an index.

(1) Applies to equity investments held in Toews Funds, but does not include investments managed in Toews annuities or life insurance products.

(2) Source for all returns: Morningstar.com

(3) Toews intends to allocate cash amounts from Toews Funds’ equity investments not committed to margin to a tactical aggregate bond strategy, investing among medium to short duration bonds to attempt to produce higher yields than money market instruments.