I spoke at a client event in Grand Rapids, Michigan in November, about a month after the recent downturn began to accelerate. After the meeting, when talking with clients, a number of them shared with me their vulnerability to market declines, and how important it was to try to avoid any significant losses. When markets turn lower, investors may wonder if it’s a blip or something that will escalate into a crisis. Risk management may be just a phrase to investment theorists and academics. But for investors, especially individual investors, risk translates to, “Will I be able to support myself, or will I be broke?” For most people, financial well-being ranks second in importance, immediately after their health and that of their family.

Investments offered by many conventional managers fluctuate with the markets. Many Toews strategies, however, are high conviction strategies that attempt to participate in gains when markets advance but seek to avoid losses when they occur. Our algorithms attempt to detect the very early stages of declines and exit or move to defensive positions. We help provide solutions to the question, “What if this becomes a market crisis?”

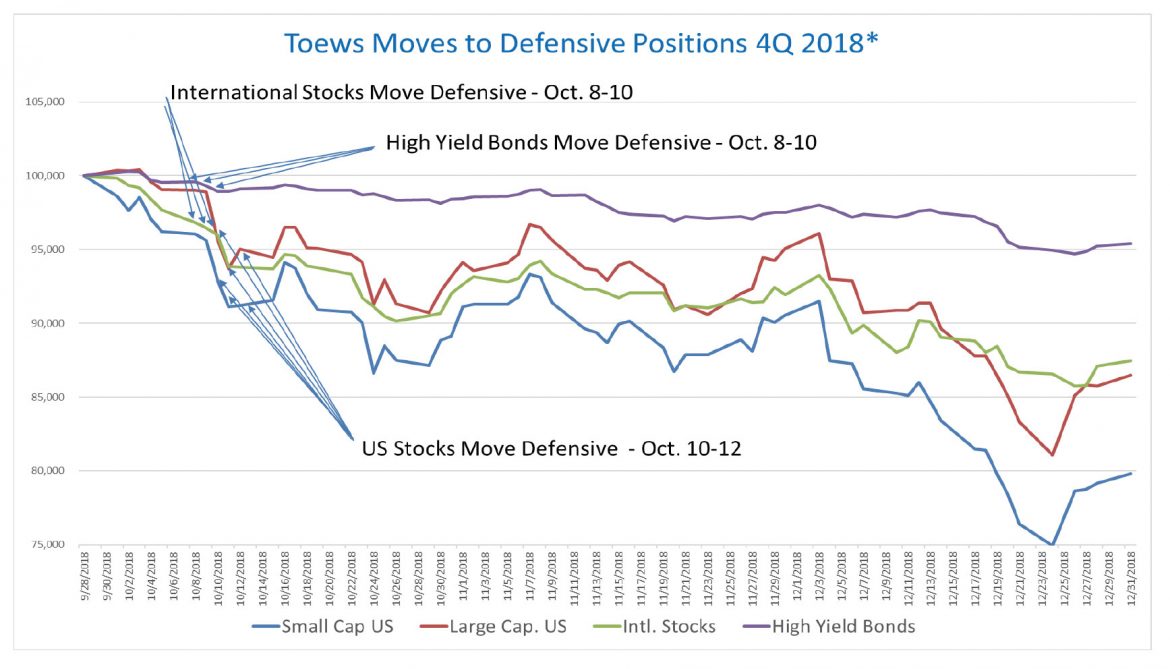

We began the fourth quarter with a bullish posture. When the downturn began in early October, our models turned fully defensive1 and remained defensive through the end of the year. Our models saw some losses before we became defensive. However, after we exited, small and mid-cap stocks lost an additional 17% through the end of the quarter, and large cap stocks lost as much as 15% (see chart above)2.

On October 1, many US investors perceived that everything was fine and may have had decent gains in their portfolios. Three months later, stocks had fallen into what appeared to be a bear market, and stock news was prominent in financial headlines. Some investors may feel that stock declines are easy to predict, but they rarely are. Now that the S&P 500 Index briefly entered into bear market territory, here’s what matters in the coming year:

- While stocks moved lower in the past quarter, earnings have improved. As a result, stock valuations are better than they were a year ago. Just as investors are pulling assets from stock mutual funds, the prospects for gains ahead may be improving.

- High yield bond portfolios showed small losses during 2018. As a result of the drop in price, interest paid on high yield bonds has increased and is now 7.583. The spread between their yields and the yields of corporate bonds has expanded over the past year, so high yield bonds may again be poised for higher returns over the coming year.

Both points above once again illustrate the counter-intuitive nature of investing. When the perception of fear rises, the opportunity for gains improves. As fear peaks, opportunities can become optimal.

While Opportunities have Improved, Risks Remain

In the last quarter, a profound change took place. Since the Great Recession, the Federal Reserve has helped prop up financial asset prices. From 2009 through 2014, the Fed changed policy in direct response to market events. Until the end of 2015, it kept interest rates at historic lows, and finally began increasing rates over the past three years. After a decade of supporting market prices, Fed Chairman Powell remained firm in his December statement that rates would continue to rise, even as stocks were falling into bear market territory.

The reaction was palpable. After a decade of relying on the Federal Reserve to help support prices of financial assets, all doubt about their new stance was removed. Although this is unfamiliar territory for new investors, before the last decade the Federal Reserve had not traditionally supported asset prices long-term. In the coming year, the Fed will be returning to its primary role of maintaining stable inflation and maximum sustainable employment.

While investors may dislike this new reality, it may improve prospects for Toews clients. Throughout our early history managing portfolios, we came to expect market declines of 20% or greater every three of four years. These declines created opportunities for us to exit and re-enter the markets with greater return prospects and in some cases improved our returns relative to market indices. Until the past quarter, investors hadn’t experienced a bear market for almost ten years.

Other ongoing risks remain clear. As I write this commentary, the government is in its longest shutdown ever. China trade negotiations remain another big cause for concern. At a certain point, negative perceptions can tip the economy into a self-perpetuating downturn that will take over regardless of the success of trade negotiations.

Our Objective is to Prosper, Regardless of Market Direction

We’re interested in managing risk. But our investment products have also been designed to attempt to gain during rising markets. In other words, we’re attempting to address both best and worst-case scenarios. We have built in a process for attempting to reduce losses. However, we also take the position that best case scenarios may occur.

By addressing both types of scenarios, we hope that this fosters a sense of stability about your portfolios.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

This document refers to the performance of the majority of Toews portfolios to illustrate the effect of Toews management on US and intl. stocks and high yield bonds. Performance of individual accounts varied based on the client’s investment risk profile and their specific investment funds. For your individual account performance, please refer to the enclosed quarterly statement or the quarterly statement recently sent to you. In addition, not all model portfolios were referenced in this letter. It is not, nor is it intended to be, a comprehensive accounting of Toews asset management. There are other portfolios that Toews manages that performed differently than what is referenced in this letter. For a complete list of GIPS firm composites, their performance results and their descriptions, as well as additional information regarding policies for calculating and reporting returns, please go to www.toewscorp.com. Toews Corporation acts as the investment advisor that implements the asset allocation and models for each of the portfolios. Investors cannot invest directly in an index.

(1) Whereas the aggregate bond and inflation protected bond positions are defensive in a rising interest rate environment by allocating to short duration bonds, their move back to aggregate bonds and TIPS in a falling equity environment is defensive as to the equity market.

(2) Source of data: Bloomberg Finance, L.P.; accessed 01/08/2019.

(3) Source of data: ICE Benchmark Administration Limited (IBA), ICE BofAML US High Yield Master II Effective Yield [BAMLH0A0HYM2EY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY, January 8, 2019. Price is as of 01/04/2019.