We are stuck.

We have spent hours debating the jargon from the Fed like “transitory”, “growth below potential”, “soft landing”, and the latest one they have dragged out, “growth recession.” Trying to wring market direction from these words is fruitless, yet endlessly compelling.

Early last year when Powell said he believed inflation would be “transitory” it marked the first time a non-poet had used the word in recorded history. While “soft landing” is vague we all seem to know what they mean with this one.

Growth below potential is a hilarious way to talk about the economy. It reminds me of that kid in school who was not living up to their potential. He was a hooligan.

A growth recession is an oxymoron. This is not a new term to reference an economy growing at a slow enough pace that more jobs are lost than created. The implication is that the Fed has it totally under control and can ramp growth back up to full potential without rekindling inflation any time they want. Noooo problem.

There are arguments to be made on both sides of the bull/bear call right now. Valuations have improved, Q2 earnings were strong, US workers are employed and spending. However, the Federal reserve has committed to slowing down the economy to decrease inflation. We are also experiencing decelerating housing, geopolitical risk of war, and the lingering covid mess.

We won’t know until we look back after the Fed has de-growthed (I am hoping they use this one next) the economy either too much, and has to kick it back into gear, or the perfect amount, which seems like a hard target to hit.

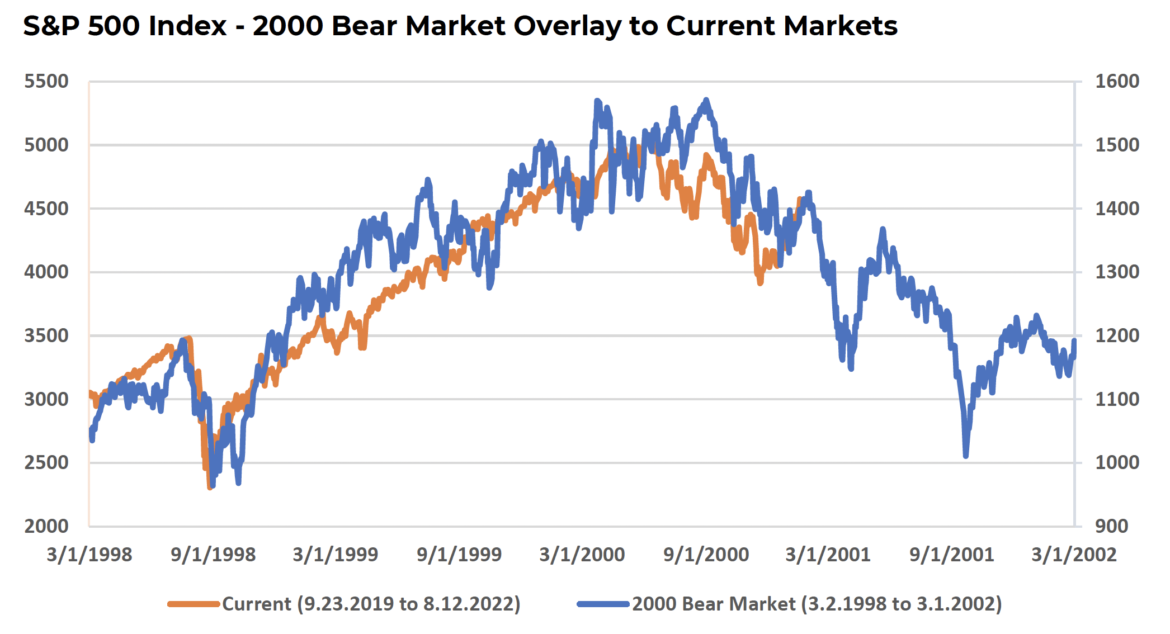

When we look at the graphic history of the two most recent non-pandemic driven bear markets, our current position does not look good.

You can see both the Dot Com bust and Great Financial Crisis had significant rallies on their way down to the painful depths that wiped out fortunes and changed (at least temporarily) investor psychology. The recent S&P 500 movement overlayed on top of these historical markets look eerily similar to these past bears.

Temporary rebounds in the midst of larger declines are common. They are sometimes colorfully called a “dead cat bounce” or a “suckers rally”. Since we are in polite company, I will refer to them as Bear Market Rallies. It is impossible to know whether the recent decline is the end of a bear market rally with more pain to come or just a soon to be forgotten blip.

The 60/40 portfolio is now pretty much in bear market territory which is not how it is supposed to work. The conventional tools of this magical beast – the ability to rely on the bond part of the 60/40 portfolio for offsetting gains is over for now. one needs to seek out managers who have the ability to maneuver whichever way this market takes us.

Disclosure:

This communication contains confidential information and is intended only for the individual(s) named. Toews Corporation (“Toews”) does not waive any confidentiality or privilege. If you are not the intended recipient, please notify the sender immediately and delete it from your system and do not copy, distribute, disclose or otherwise act upon any part of this email communication or its attachments.

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This presentation may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “probable,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This presentation is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice.

S&P 500 Index is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. It measures the movement of the largest issues. Standard & Poor’s chooses the member companies for the 500 based on market size, liquidity and industry group representation. Included are the stocks of industrial, financial, utility, and transportation companies. Since mid-1989, this composition has been more flexible and the number of issues in each sector has varied.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or visit our website at www.toewscorp.com.

© Toews – May be used free of charge. Selling without prior written consent prohibited. Obtain permission before redistributing. In all cases this notice must remain intact. All rights reserved. Toews is not affiliated with an advisor who uses this information, whether by permission or otherwise.