The strong rally that began at the end of March continued through early September, and then turned lower as covid cases continued to escalate across the country, causing fears that the market rally had gotten too far ahead of itself. In the past couple weeks, however, stocks have moved higher once again.

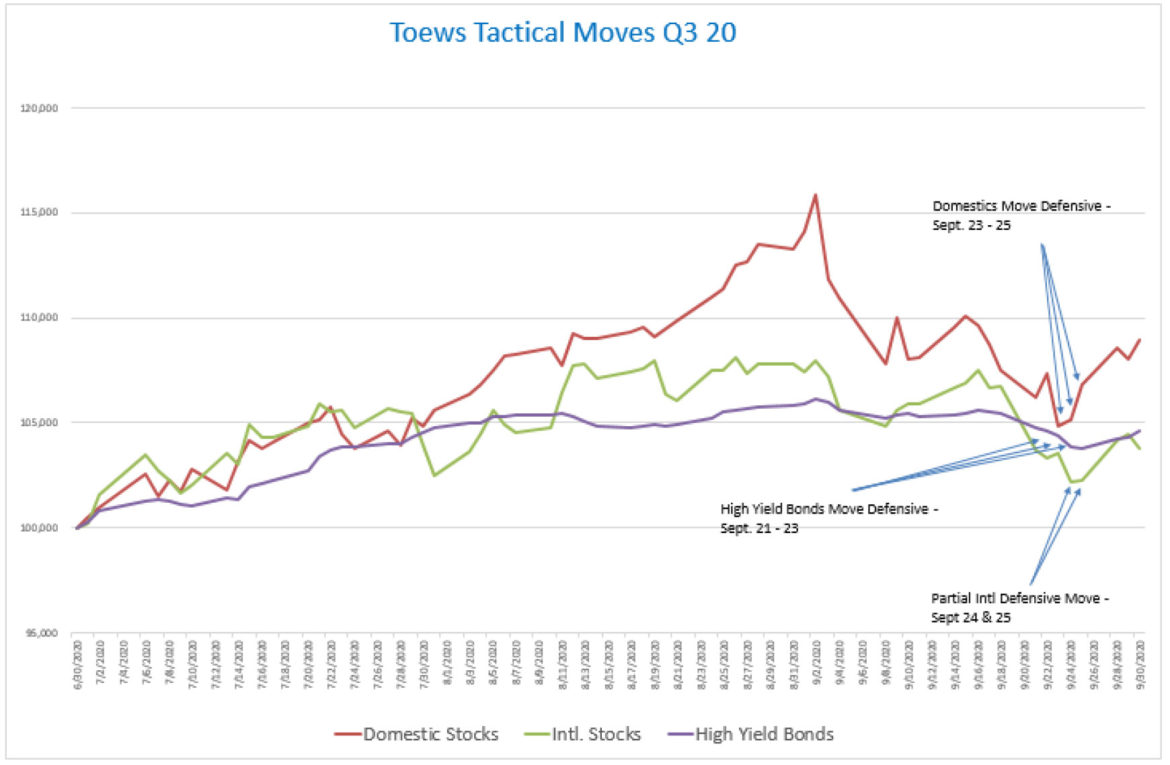

Our algorithms moved us into a defensive posture in September as stocks fell, but are now moving us back to invested positions.

Challenges ahead include an uncertain election outcome, a persistent virus, and employment numbers that appear to suggest that the recovery may be waning as we enter the fourth quarter. The election challenge may depend more on having a decisive victor for the presidency, with a smooth transition following the election, than on who wins. Although Democrats have a reputation for increased taxes, providing a perception that their control of the presidency and the legislature might cause an economic downturn, stock markets have done very well during the last two Democratic administrations.

Stock Market Valuations, the Federal Reserve, and Fiscal Stimulus

In our view, the stock market rally from earlier this year will struggle as it isn’t supported by company earnings, and growth projections are too lofty. However, although ultimately we believe that stocks are bound to move lower, we are entering what has historically been a favorable time for the stock market in the months of November and December.

Another factor not to be forgotten is the support of the Federal Reserve and the effect of a potential fiscal stimulus bill being passed. In March, as the stock market touched its lows of the year, the Federal Reserve (FED) launched several initiatives that helped spur the market higher. These included lower interest rates, and facilities that allowed them to purchase bonds, including high yield bonds. The reaction was a market that surged higher as investors may have felt that the intent of the FED was to provide limits to stock market losses. At the same time, Congress passed generous fiscal measures that provided additional unemployment funds and support for businesses.

As the markets seemingly threaten to add to the losses in September, the Trump administration and Congress are once again negotiating a fiscal stimulus that could help sustain the markets through the end of this year. The result of those negotiations could determine the direction of markets, as employment growth has disappointed in the past month and economic pressures build.

We are Here to Attempt to Help You Manage Risk

We often suggest that markets are vulnerable to either scenario, optimistic or pessimistic, and this quarter is no different. However, due to the global pandemic, high unemployment, and over-valued markets, the current environment may be even more likely to generate significant trends. Patients infected with the Coronavirus may appear healthy one moment, but then see their blood oxygen levels drop precipitously. The markets could be similarly afflicted. Normalcy in market activity may disguise underlying vulnerabilities.

Our investors have many issues related to the Coronavirus Crisis, including their health, their jobs, their incomes, and the viability of their businesses. At these times, it can become even more important that your portfolios attempt to manage risk. Toews strategies were conceived with the objective of attempting to help navigate extreme and unexpected markets*. Over the coming year, it is likely that news at times will cause investors anxiety. Remember, however, that at Toews, we have strategies that attempt to address significant long-term declines.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. *There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

The ICE Bank of America Merrill Lynch US Cash Pay High Yield Index has been used as a comparative benchmark because the goal of the above account is to provide bond-like returns. The index is generally used to measure market performance of fixed-rate, coupon-bearing bonds with an outstanding par of greater than or equal to $50 million, a maturity range greater than or equal to one year and must be less than BBB/Baa3 rated but not in default.

The MSCI EAFE Index is an index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance of large and mid-cap securities in developed markets in Europe, Australia and Southeast Asia, excluding the U.S. and Canada.

The Nasdaq Composite Index is a large market-cap-weighted index of more than 2,500 stocks, American depositary receipts (ADRs), and real estate investment trusts (REITs), among others.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.