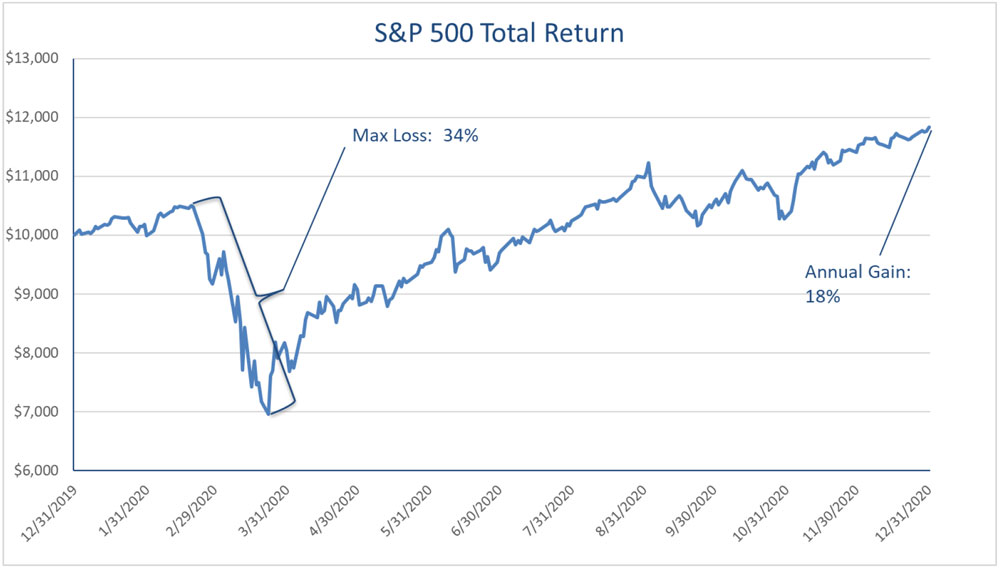

For the year, the S&P 500 moved higher by 18.4%, a remarkable feat considering the elevated levels of unemployment, business bankruptcies, and disruption of the travel, hospitality, and entertainment industries. The year provided our investors an opportunity to see how Toews strategies functioned during a bear market, the first realized since the 2008 financial crisis1. In this commentary, I’ll discuss how our algorithms functioned as the year played out, our views on the markets moving into 2021, and how we recommend that you position portfolios in what remains a challenging climate for investors.

Toews Navigates Market Chaos

Despite news of severe illness in China from the Coronavirus in early 2020, markets advanced until they hit a wall in February. As the reality of the severeness of the pandemic set in, stocks began one of their most rapid declines in history, falling 34% in just 24 days.

Source of Data: Bloomberg Finance, L.P. Accessed 01/11/2021. This illustration assumes an initial investment of $10,000 for ease of calculation. The Max Loss during the period of 2/19/2020-3/23/2020 was -33.8%. The Annual Gain for the year was 18.4%. (i)

Toews strategies began moving to defensive positions in late February and were fully defensive by March 3. The 34% drop from peak to trough was not only justified by the loss in economic activity, but was potentially only a fraction of the losses that could have been realized if countermeasures by the government had not been enacted. By the end of March, the virus was spreading rapidly, and the country went into a lock down. It’s hard to overstate the magnitude of the economic stress that the global economy experienced. The US realized a second quarter GDP decline of 31.4% (ii) on an annualized basis, more than at any time since the Great Depression. Unemployment soared to as high as 14.8%. Our perception was that we were potentially headed for a depression. At the time, there was little indication that we would be successful at producing vaccines quickly. It appeared like we were headed off a cliff.

It’s important to think about investors who hold stocks, bonds, or other risk assets at moments such as these. During the Great Depression, stocks fell as much as 84% over 2.5 years. When stocks enter free-fall, investors may imagine the worst, and exit or, if they hold onto stocks, can experience stress and discomfort as volatility prevails.

During March, we conducted an investor survey with the Investments and Wealth Institute and Absolute Engagement (iii) about investors’ ability to tolerate market disruptions. Two-thirds of investors said that they were inclined to accept lower returns if they were confident that the probability of experiencing significant losses due to negative market events would be lowered; and only 11 percent disagreed. Our investors have an explicit plan in place to attempt to address chaotic markets.

In response to the pandemic, Congress passed a two trillion dollar fiscal stimulus that was enacted on March 27. This, combined with dramatic action by the Federal Reserve Bank to provide liquidity, caused the markets to stabilize and turn higher. These actions are viewed as largely responsible for preventing a further collapse in financial assets and the economy.

From April through the end of the year, markets powered higher. During the remaining part of the year, Toews moved either partially or fully defensive several times in reaction to shorter term downturns, but spent a majority of the time fully invested. From mid November through the end of the year, we were in a fully bullish posture, where we remained at year end.

Expectations for 2021

Just as the market decline was rapid, the rebound and move to new highs occurred at brisk pace. We ended the year at elevated valuations. As of December 31, 2020, the S&P 500 was priced at 22.3 times forward earnings, a 34% premium over the average level of 16.6 over the past 25 years.(iv)

Our observations regarding the coming year in the markets is that:

- At elevated valuations, markets may be more vulnerable than normal to lower returns and market losses. When risk is higher, investors should ensure that they have risk management measures in place to try to address falling markets.

- Growth estimates for stocks and the broader economy are optimistic, and assume a return to a normal economy over the next 24 months. If damage to parts of the economy prove harder to repair, and the economy takes longer to recover, it may be a challenging environment for stocks that are near their historic highs.

- Humans tend to be optimistic. If vaccinations aren’t successful at taming the pandemic, it may have a profound effect on our path forward and return to normalcy.

Despite these assessments, stocks continue to produce gains. Several factors may be driving markets higher. First, there are few alternatives. With bonds producing near historic low yields (the 10 year treasury is currently yielding around 1%), investors are incentivized to seek higher returns. Second, momentum may drive people into stocks as they watch gains play out, further pushing stocks higher.

Positioning Portfolios for a Challenging Environment

Over the coming year, it is likely that news at times will cause investors anxiety. Remember, however, that at Toews, we have strategies that attempt to address significant long-term declines.

Based on our March investor survey, by proactively having a clear plan for addressing market crises events, investors may have more confidence in their financial future. Remember that at Toews, we have strategies that attempt to address significant long-term declines.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

(i) A total return index is a type of equity index that tracks both the capital gains as well as any cash distributions, such as dividends or interest, attributed to the components of the index. The S&P 500 index is a basket of 500 large US stocks, weighted by market cap, and is the most widely followed index representing the US stock market. It is not possible to invest in an index.

(iu) https://www.bea.gov/news/2020/gross-domestic-product-state-2nd-quarter-2020#:~:text=Real%20gross%20domestic%20product%20(GDP,U.S.%20Bureau%20of%20Economic%20Analysis. Date accessed 1-8-2021

(iii) Toews sponsored and designed the survey, which was implemented by Absolute Engagement and distributed by Investments & Wealth Institute. See “2020 investor Research Special Report: investor Behavior in a Market Crisis,” Investments & Wealth Institute (June 2020), iwicentral.org/2020BehavioralResearch.

(iv) https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/. Page 5. Date accessed 1-10-2021