In our quarterly market commentary, advisors are accustomed to seeing sometimes bleak assessments about future stock market growth. These projections have been rooted in a seemingly perpetual over-valued market supported by a seemingly perpetual dovish Federal Reserve. But in no time in my history have I witnessed an environment where both stocks and bonds are more vulnerable to losses than they are now. Put another way, all of the stars are all aligned for market imperfection. As a tactical and hedged asset manager, this simultaneously becomes an environment for optimism and potential gains if we’re provided an opportunity to buy at depressed prices following declines.

The challenges include the Federal Reserve stomping on the brakes, inflation that is exacerbated by the invasion of Ukraine and a tight labor market, and continued high stock price/earnings ratios. I Will discuss each of these separately and present data that illustrates the extremity of some of the challenges ahead. Most of the charts and data come from our recent Economic and Capital Markets update, available for download here.

Energy, Food, and Labor Drive Inflation Higher

Last month I drew an analogy between the 1990 Kuwait and this year’s Ukraine invasions. In both instances globally stability was threatened, and energy prices were driven higher. In the first few months after the Kuwait invasion, oil prices nearly doubled and stocks were driven lower.

Last month oil initially surged as high as $140 per barrel, only to move back towards $100 barrel in recent weeks. Gas prices, however, remain higher by over 28% since the beginning of the year. In our view, absent a withdrawal of Russia from Ukraine, energy prices will see additional price pressures as supply issues increase over the coming months. Shortly after the Ukraine invasion, estimates were that oil could see prices higher than $200 per barrel, representing a doubling of prices. If that were to occur, it could create significant additional headwinds to the global economy.

As serious as concerns about energy supplies are, the continued effect on global food supplies are even starker. Combined, Russia and Ukraine make up a significant portion of global wheat, barley, and sunflower oil exports. Predictions are dire for the effects of food supply disruptions, including possible famine in vulnerable countries and cost of living challenges across the globe.

Combined, energy and food make up over 20% of CPI, but energy effects many other inflation components that ultimately effect inflation, with transportation being the most obvious.

Thankfully for the U.S. economy, unemployment has returned to pre-pandemic levels (3.6%) that reflect full employment1. But we appear to be beyond just full employment, and now have an employee shortage. The labor department says that there are only 0.6 unemployed for every job opening in the country2, suggesting that there are 4.6 million more jobs available than there are unemployed3. The confluence of allof these issues is acting to push inflation estimates higher. Can we all agree…..not transient?

INFLATION (FINALLY) SPURS THE FED TO ACT

As recently as November of last year, the FED said that it expected high inflation to be transitory4. This week, Philadelphia FED president Patrick Harker said that he is “acutely concerned” about inflation, and sees “deliberate” rate hikes5.

The yield on the 10-year treasury bond has already climbed from 1.5% at the beginning of the year to 2.6% today. And the futures market is pricing in an additional 2.7% in Fed Funds rate increases by 20236. All of that translates into additional headwinds for stocks and potential further bond losses this year.

In the past week, the investment grade bond market entered a bear market in real terms, having lost 20% since the beginning of 2021 after taking into account inflation. If the FED raises rates as is expected, investors may see these losses increase.

STOCK MARKET GYRATIONS BEHIND AND AHEAD

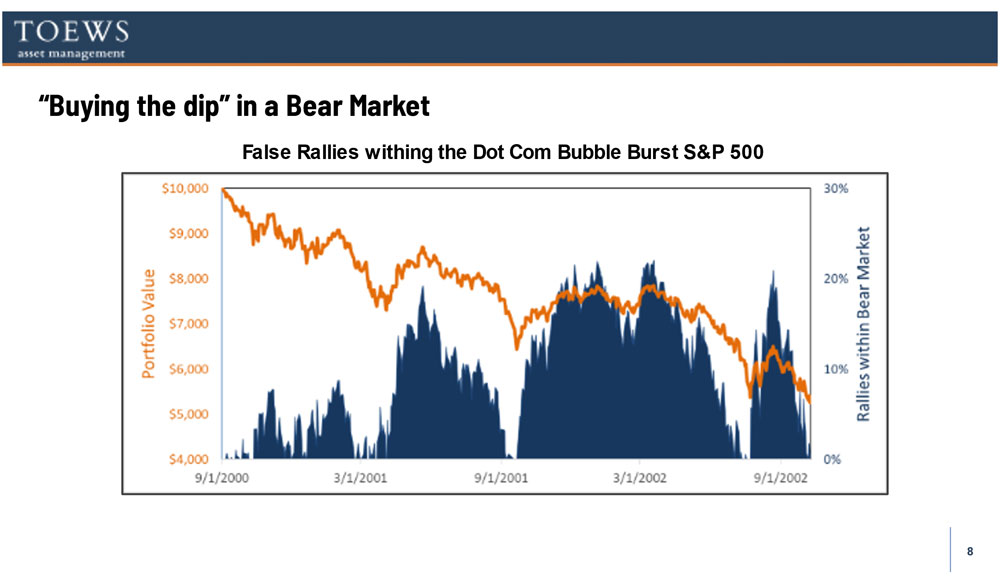

Even before the invasion of Ukraine stocks fell earlier this year. As Russia followed through and initiated a full invasion of Ukraine stock losses accelerated. However, as oil prices retreated from their highs, stocks began a significant rally, and ended up nicely from the worst levels of the quarter (albeit still generally down). Our team had numerous conversations with advisors who declared the bottom in who were aggressively “buying the dip”. That leads us to share the next chart. Longer term bear markets tend to not be just one move lower, but many. Down markets may have a number of short-term bull markets within the a longer term bear (aka bear market traps).

During the bear market following the internet bubble, there were 6 distinct times when the S&P 500 rallied 5% or more, and three rallies nearing 20% or more. Unfortunately, after learning that buying the dip was a potential path to prosperity, investors may now need to transition to “selling the rallies” in order to help preserve their portfolios.

COURSE CORRECT TO ADDRESS ELEVATED MARKETS

It’s been decades since investors confronted the possibility that both stocks and bonds might move down together. Without bonds bolstering stock market losses, it may be more important than ever to pursue alternative approaches to mitigate risk.

Despite the heavy weight of evidence suggesting further declines ahead, we suggest that you avoid making outright market calls. Instead, attempt to remain invested but address the contingency that both stocks and bonds may fall further by taking these steps:

Place half of your stock portfolio into hedged equity or high conviction tactical portfolios or funds in an attempt to address potential stock market losses.

Move fixed income portfolios into adaptive or unconstrained funds that attempt to mitigate the effect of rising rates or inflation.

Taking this approach may not only help lessen losses during a chaotic market, it may allow investors to potentially capitalize on market dislocations by positioning them to sidestep a portion of declines and capture rebounds that follow. Less sexy than getting rich without really trying, the current objective may be attempting to “not get poor without really trying”.

Disclosure

Prior performance is no guarantee of future results. There can be no assurance, and individuals should not assume, that future performance of any of the portfolios referenced will be comparable to past performance. There can be no assurance that Toews will achieve its performance objectives.

This commentary may include forward-looking statements. All statements other than statements of historical fact are forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements.

This commentary is intended to provide general information only and should not be construed as an offer of specifically-tailored individualized advice. Please contact your investment adviser, accountant, and/or attorney for advice appropriate to your specific situation.

The S&P 500 Index (S&P) is one of the world’s most recognized indexes by investors and the investment industry for the equity market. The S&P, however, is not a managed portfolio and is not subject to advisory fees or trading costs. Investors cannot invest directly in the S&P 500 Index. The S&P returns also reflect the reinvestment of dividends. Clients or prospective clients should be aware that the referenced benchmark funds may have a different composition, volatility, risk, investment philosophy, holding times, and/or other investment-related factors that may affect the benchmark funds’ ultimate performance results. Therefore, an investor’s individual results may vary significantly from the benchmark’s performance.

Investors cannot invest directly in an index.

For additional information about Toews, including fees and services, send for our disclosure statement as set forth on Form ADV by contacting Toews at Toews Corporation, 1750 Zion Road, Suite 201, Northfield, NJ 08225-1844 or (877) 863-9726.

(1) https://www.bls.gov/news.release/pdf/empsit.pdf

(2) https://www.bls.gov/charts/job-openings-and-labor-turnover/unemp-per-job-opening.htm

(3) https://www.cnbc.com/2022/02/01/there-were-4point6-million-more-job-openings-than-unemployed-workers-in-december.html

(4) https://www.reuters.com/business/with-bond-buying-taper-bag-fed-turns-wary-eye-inflation-2021-11-03/

(5) https://www.cnbc.com/2022/04/06/feds-patrick-harker-is-acutely-concerned-about-inflation-sees-deliberate-rate-hikes.html

(6) Source: Bloomberg